Electronic devices are not only more vulnerable to damage but also expensive and hard to replace. Yet the most important thing for your business and employees is ensuring that the electronic equipment you use functions right always. Damaged devices can often affect operations and cost your business as you’ll have to replace the broken or stolen ones, and some work might stop without them.

Many businesses trust employees with valuable electronic devices such as desktop computers, tablets, cash registers, laptops, etc. However, they often experience theft or damage of a corporate electronic device caused by various factors. So choosing a business electronic device insurance plan needs careful decision-making and research.

Fortunately, an electronics device insurance policy for your business can safeguard your needs and help mitigate the cost of such electronic breakdowns.

Here’s a guide to help you understand business device insurance policies and what they cover.

What Is a Business Device Insurance for Electronics?

A business device insurance for electronics is typically a coverage plan designed to provide exclusive and comprehensive coverage for electronic devices used by a business.

This can include computers, cash registers, laptops, point-of-sale devices, and any other electronic equipment you work with in your daily business operations.

In addition to repairing or replacing damaged, lost or faulty devices, electronic insurance can also cover the business cost of restoring lost data due to failure of the electronic equipment as well as other expenses related to a business interruption caused by the equipment breakdown.

What Type of Business Insurance Protects You From Damage to Your Equipment?

While there are few stand-alone device insurance policies for electronics like AKKO, protection for your electronic business equipment and other assets is included in the Business Owner’s Policy (BOP), which is often considered a foundation for electronics device insurance. A BOP combines three essential coverage types to help safeguard your electronics from risks. These include:

General liability insurance

This business insurance plan helps cover claims that your electronic equipment caused property damage or bodily injury to someone else. While this doesn’t involve direct damage to your electronics, it’s a crucial type of business insurance to help you cover issues caused by your devices.

Commercial property insurance

This covers standard equipment perils such as damage or theft to electronic devices. Your property insurance policies cover electronic equipment used primarily for work and their software. If your device is lost, damaged, or stolen, property insurance pays for the repair and replacement up to your policy limits.

Typically, property insurance helps protect your owned or rented commercial building, tools, and equipment you use to operate your business, including computers, cell phones, tablets, inventory, software, parts, etc.

Errors and omissions insurance (E&O)

While a property insurance plan will protect your electronic equipment, it will not cover your business from certain liability types associated with your work on the device. If, for example, an employee loads an email containing a virus that then infects your business computers, your insurance company could hold you liable for damages and refuse to pay the cost of repair or replacement.

Errors and omission insurance help cover electronics breakdown related to professional mistakes. In addition, this policy is combined with cyber liability insurance that protects against mistakes that could lead to data breaches or cyber-attacks that affect business operations.

AKKO

When looking for the most reliable business device coverage for electronics, the AKKO protection plan is a leader with customizable policies. While AKKO offers a phone-only protection plan protecting your business cell phones from common issues like theft, internal breakdowns, and accidental damage, it also offers a more comprehensive “Everything Protected” plan.

With this comprehensive insurance plan, you can receive reliable, high-quality electronic device insurance for your cell phones, along with comprehensive coverage for up to 25 of your most valued items. The good news is that once you’ve locked down protection for your electronic equipment, such as a smartwatch, tablet, desktop computer, or laptop, you’ll still likely remain with several spots left that you can use to cover other valuable business items.

This AKKO insurance plan allows you to enjoy coverage for various electronic devices as well as photo and video work equipment, gaming consoles and accessories, music and audio equipment, business supplies, non-motorized transportation, and so much more.

The “Everything Protected” plan from AKKO covers various malfunctions and issues, including theft, vandalism, accidental damage, and internal part failure claims. With AKKO, you can file unlimited claims for business devices and enjoy low deductibles.

Business device insurance vs. Manufacturer’s warranty

When you buy new electronic equipment like desktop computers or laptops, you can include a manufacturer’s or extended warranty to shield your business against common failures and breakdowns. However, the original manufacturer’s warranty doesn’t cover most electronics failures.

Device insurance plans extend beyond the basic stipulations of a warranty as they cover issues like mechanical breakdown or data loss in addition to vandalism, theft, and accidental damage. So businesses should always consider device insurance in addition to a manufacturer’s warranty.

Who Needs Business Device Protection?

Electronics device insurance is essential for small, medium, and large businesses. Any business that uses electronic devices in its operations should have protection from an insurance plan. It could be included as a stand-alone protection agreement or together with commercial property insurance.

You probably need device insurance for business electronics if you have any of the following items:

- Desktop computers / PCs

- Software

- Servers

- Office equipment (Modems, Printers, Scanners & Fax Machines)

- Business telephone systems or PABX

- Fixed Medical Equipment (such as X-rays, radiology, weighing scales, etc.)

- Other electronic devices

In general, electronics device insurance is often addressed at trade, manufacturing, or service companies, including:

- Technology product manufacturers

- Software manufacturers.

- Electronic device manufacturers

- Data processing centers,

- Electronics stores

- Cell phone distributors and stores

- Technology product research and development

- Computer stores

- Office equipment and supply stores

- Financial institutions

What Does Business Device Insurance Cover?

Managing a business is hard enough without worrying about a breakdown or failure in your electronic equipment. Often, such incidents result in increased work hours until you can get damaged equipment fixed or replaced.

Business device insurance for electronics comes in various coverage types to help deal with increased costs associated with electronic equipment loss or breakdown, including:

Breakdown coverage: This allows the insurance company to pay for the cost of repair or replacement of the equipment.

Restoration of lost electronic data: If you lose corporate data due to a damaged part of electronic equipment, this coverage will cover the cost of replacing or restoring the lost data, if possible.

Additional increased working cost: In most cases, when electronic equipment fails or breaks down, it creates additional work. This coverage will pay for these extra working costs.

Overall, device insurance for electronics helps protect your business from common damage risks and claims during normal business operations. It covers consumer products like laptops or digital cameras, computer parts, communications equipment, and technological or electronics components.

Therefore, a business device insurance policy should cover various possible perils. Your electronics device insurance should typically cover issues such as:

- Water damage (including submersion and liquid spills)

- Damage from dropping or stepping on your electronic equipment

- Accidental damage

- Internal damage due to factors such as short-circuiting etc

- Cracked screens

- Theft and vandalism

Insurance cover for electronic devices is suitable for equipment susceptible to damage and other issues usually found in an office work environment, hospitals, etc.

In the case of business computers, the selected policy can also be extended to include coverage for costs of replacing damaged or lost external data media as well as costs of reproducing or restoring lost data. Any additional costs of working extra hours due to damage or loss of electronics can also be recovered under your policy.

What isn’t covered by a business device insurance policy?

Business device insurance plans have exceptions and limits that determine how much the insurance company will cover a claim. Common exclusions to device insurance coverage for electronics include:

Excluded damages: Unfortunately, there isn’t such thing as truly comprehensive device insurance; every coverage policy has certain exclusions for specific causes or events under which it won’t pay to replace or repair damaged or lost electronic devices. These may include willful acts or negligence, gradual deterioration, aesthetic defects, and consequential losses. So before choosing a business device insurance, make sure it includes coverage for all possible incidents that could happen at your business.

New electronic devices: If your business grows and expands to purchase new electronic equipment, you’ll also have to update your coverage policy. Reach out to your insurance provider to expand your equipment coverage when the time comes.

Damage beyond insurance policy limits: Buying too little device insurance coverage can harm your business over time. Work with your provider or agent to help you choose an appropriate coverage limit that fits your business.

By having your electronic equipment covered by a business device insurance policy, you can ensure the continued smooth operation. And even if a piece of electronic equipment breaks down, the insurance policy should cover any extra costs your business incurs as a result.

The best way to prevent equipment breakdown is to train workers in electronics use properly and to perform regular maintenance on the electronic equipment. But in cases where such measures don’t help, a business device insurance policy can help get your functions back on track in no time.

How Does Business Insurance For Electronics Work?

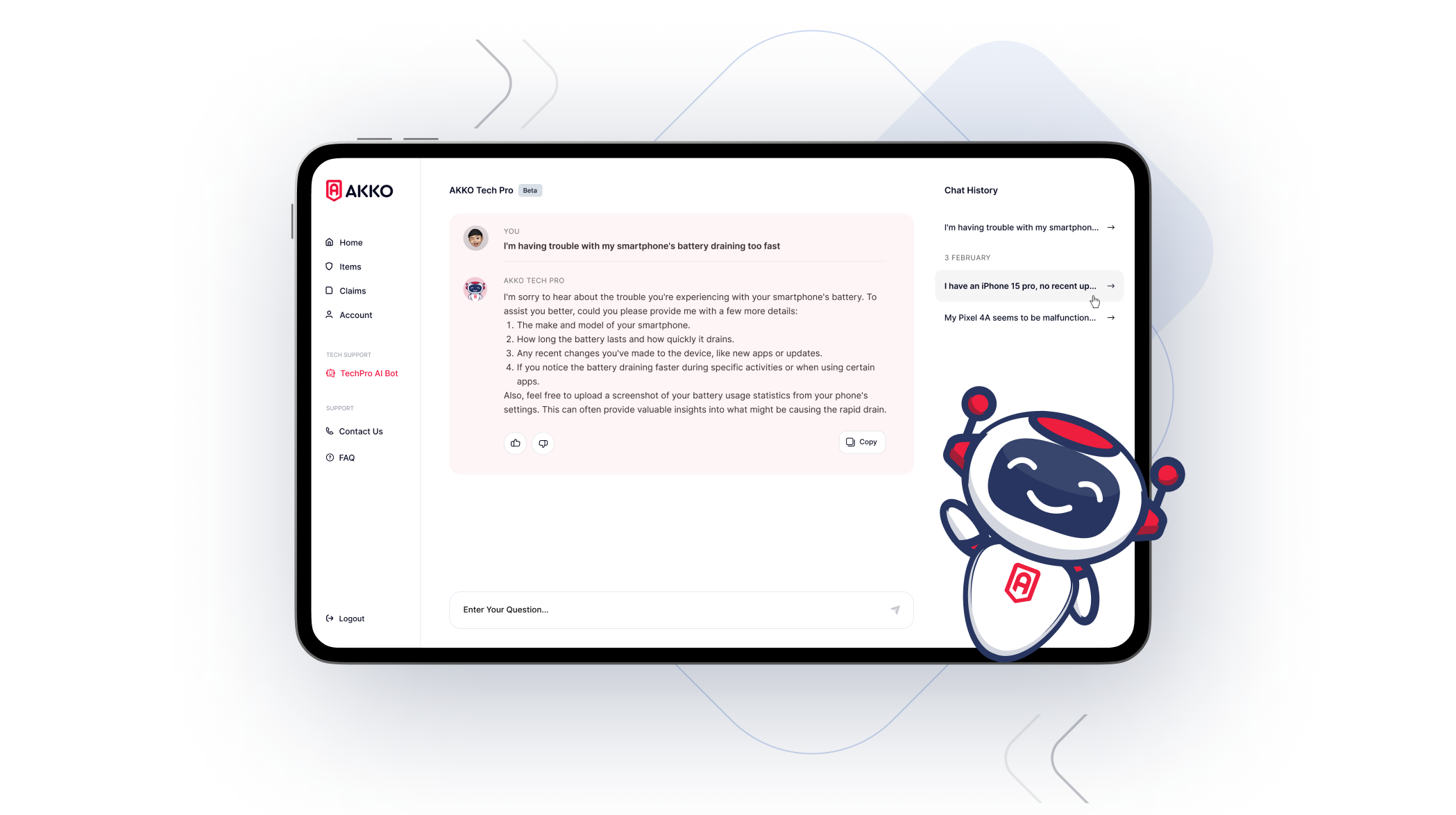

If you are using the AKKO insurance plan for your electronic devices, you can set up your plan in just a few steps.

Use your smartphone to register online by downloading the free application. Then sign up for your desired protection plan in minutes.

Once you’ve chosen your preferred protection plan, the program will ask for some information about what items you’ll want to be covered. Simply take a few clear photos of the items in their current condition, and that will be it! Your devices are now covered by your chosen insurance plan and can be shielded from any issues that might arise.

In case of an event, you can file a claim for repair or replacement costs through the AKKO app, and they will be able to set up a solution as soon as possible.

Benefits of AKKO for Businesses

Using AKKO as a solution for device insurance plans gives consumers numerous benefits that translate to freedom.

With AKKO electronic device insurance, you can:

Insure used and refurbished devices

For conscious spenders, buying a new device isn’t always the goal since used, and refurbished electronics can function just as well as a new one. However, most insurance companies want users to focus on new devices. They usually partner with wireless carriers who, at the time of the purchase, offer consumers insurance deals for brand-new devices. And while the deals often seem convenient, the partnership is meant to make both the company and the carrier money.

But this close tie doesn’t benefit you as the customer. AKKO lets you cover whatever device you buy, whether new, used, or a refurbished item from a third-party seller.

Unlimited Claims Allowed

Most carrier insurance plans allow only a limited number of claims per year. This means that if something happens to your device past the limit in one year, then you’ve paid for the insurance the entire year yet still pay for a repair or replacement out of pocket.

With AKKO’s protection plan, you can file for an unlimited number of claims throughout the year.

Low Pricing

AKKO allows you to get the most out of your investment. With proprietary automation technology, AKKO gets significant savings and then shares the benefits with customers by lowering prices. Together with AKKO’s much lower deductibles, this can become a powerful approach for businesses wanting to save big.

Protect Your Electronic Devices

You rely on your electronic devices to help run a growing and successful business. If there’s damage or theft, having electronics insurance for your equipment is vital to help cover repair and replacement costs.

Electronic devices are as expensive as they are valuable. So even with a high-quality device protection plan from AKKO, you still need to be careful with your electronics and take necessary precautions to prevent peril. But when unforeseen instances result in damage, you will be happy to have a great device insurance provider to cover your costs. Sign up today to get the help of the AKKO team and learn more.