As a professional photographer, you may have invested thousands of dollars into your photography equipment and gear. It’s your passion! You live for that perfect shot where lighting, composition, and that unique moment all come together. And you know that good quality equipment makes a difference in the clarity and quality of your images.

Theft or damage of your camera gear could cost you thousands of dollars. No matter how careful you are, accidents happen, so having the right camera insurance for your equipment is essential.

What Is Camera Insurance?

Camera equipment insurance is liability insurance designed to protect professional photographers and videographers.

Camera equipment can be very costly, so having insurance with camera coverage can save you a lot of money if your equipment is stolen or damaged — or even lost while you are traveling.

When you go shopping for camera insurance, you’ll need to know how much your equipment is worth. Cost will likely vary by the amount of coverage you select and the value of the camera. You’ll also want to make sure you understand what is covered and what isn’t.

Won’t My Home, Renters, or Auto Insurance Cover My Equipment?

If you work out of your home, your home insurance or renters insurance company may not cover your professional camera and equipment, especially if you own photography business (or an LLC).

In other words, you may not be able to mix business and personal coverages. In most cases, homeowner’s and renter’s policies are often geared toward covering equipment for amateur photographers.

You may also be limited to certain types of claims. For example, theft from your home may be covered by your homeowner’s insurance but a cracked lens or water damage might not be.

It’s likely that your homeowner’s or renter’s insurance will cover damage from a home fire, but if you leave your camera in a taxi or it is stolen while you order a latte, it probably isn’t covered.

Additionally, your car insurance company may not cover your equipment if you are traveling. This could be a problem if you travel for a shoot and something happens on the way.

How Is Insurance Different from a Warranty?

Insurance and a warranty are two different things. A warranty comes directly from the manufacturer with a purchased product, like a camera. It is coverage for a limited time that covers predictable events, such as faulty parts.

In essence, a warranty is a time-sensitive guarantee from the manufacturer regarding the condition of your camera purchase. The length of time covered and possible failures included in coverage will vary from manufacturer to manufacturer. The duration of a warranty can be a few months, 90 days, a year, or even a few years.

In other words, the manufacturer doesn’t expect the camera to break within a certain timeframe, so they are willing to cover limited occurrences (such as a defective part or if something wears out prematurely).

However, there is often a lot that warranties do not cover: theft, accidents, drops, spills, and more. You don’t get to choose the rather limited courage of a warranty, although sometimes, you may be able to pay to extend the warranty for your camera.

Insurance is paid protection and it covers unexpected events (for example, fire, theft, and some kinds of damage). With insurance, you pay to have options with regard to what is covered, who covers it, and for how long.

How Much Does It Cost to Insure a Camera?

The cost of camera insurance can depend on the value of your equipment and what you want to have covered. The median cost of general liability coverage for camera equipment insurance is about $425 a year (or about $36 a month) — or sometimes more!

Another thing to consider with the cost of insurance is the deductible amount you’ll have to pay if you use the coverage to make a claim. Some insurances will cover your photography equipment, but the deductible is huge!

Is It Worth Getting Insurance for a Camera?

Considering how much you have invested in your camera and equipment, photography insurance is likely worth it. If you lost your camera and equipment, could you easily afford to replace it without feeling a financial pinch? For most people, the answer is no, which means that insurance is worth it, especially if the insurance is affordable — like AKKO’s coverage is!

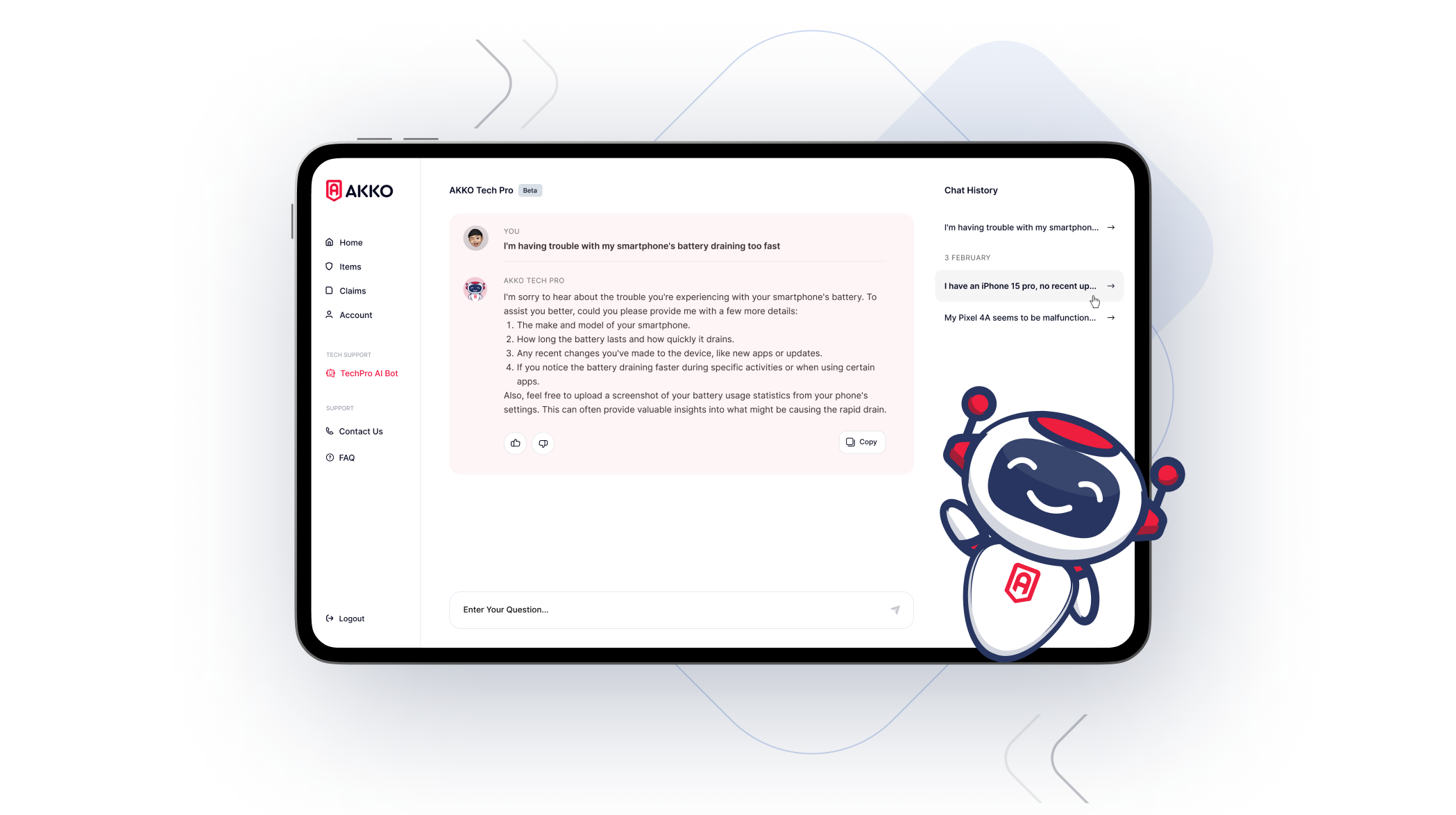

Will AKKO Insure My Camera?

Yes! With AKKO, you can sign up for phone protection plans and then add up to 25 additional items to be covered by insurance.

Base plans start at $15 a month ($180 a year). You can also sign up for family plans!

The basic insurance has a $2,000 per incident limit, and the deductible is just $99; however, you can affordably increase coverage to fully insure your camera equipment. For example, after registering, you can upgrade your coverage to a per-incident reimbursement of $10,000 if you have particularly valuable equipment.

Because AKKO insurance protects by the item, you can add:

- Cameras

- Lenses

- Tripods

- Gimbals

- Flashes

- Chargers

- and more

Also, with AKKO, there is no annual limit on reimbursements and no annual limits on the number of claims you file — not at all like the typical homeowner’s or renter’s insurance policy, which usually comes with limits on claims and reimbursement amounts.

Best of all, with AKKO, you are covered for theft, drops, cracked lenses, spills, and natural disasters!

AKKO Even Covers Theft of Cameras from Vehicles

AKKO will cover theft of your possessions from your personally owned automobile, provided the vehicle was locked and the windows were fully closed at the time of the theft. If there is visible evidence of forced entry, your equipment will be covered.

Does Camera Insurance Cover Camera Equipment?

If they offer camera insurance, most homeowner’s and renter’s insurance companies will only cover your camera and gear up to a certain amount, often known as a sublimit.

For example, in a home incident, $2,500 is covered, but if you are outside your home, only $1,500 is covered in case of an incident.

AKKO Coverage

With AKKO, you can add your camera and accessories as items under your plan and upgrade if you need to for high-dollar items.

Moreover, AKKO protects from theft, which other carrier insurance or protection plans do not cover. Check out how AKKO insurance compares to the competition:

We think you’ll be impressed with both our coverage options and pricing!

Ways to Protect Your Photography Equipment

You can’t always completely protect your camera gear from accidental damage, loss, or theft, but there are some things that you can do to minimize risk and protect your equipment.

For example, a camera strap and case is basic but useful protection against dropping your camera. Waterproof gear bags protect against rain.

It is a good idea to take pictures of all of your camera equipment and record the basic information about each piece, including the make, model, and serial number.

Make sure to keep readable copies of your receipts so that you can prove the value if you have to file a claim. While you may not be able to recover stolen equipment, the information and the pictures can assist with an insurance claim.

Deterring Theft of Your Equipment

Cameras and camera accessories are ideal targets for thieves because they are portable, generally expensive, and easy to sell online. Theft is often a crime of opportunity. After all, it doesn’t take very much time to grab a camera from a car and walk off with it.

However, there are some things you can do to protect your equipment:

- Don’t leave cameras and accessories where potential thieves can see them

- Make sure your windows and doors are locked

- Install a security system and motion detector lights in your home or studio

- Limit the number of people who have access to your studio and equipment

- Keep track of your keys and be careful about giving them out

While you can’t always prevent theft, you can minimize opportunities for thieves and make your camera equipment a less inviting target.

The Wrap-Up

You have no doubt invested a lot of money into your camera equipment and accessories. Having insurance protects your equipment in case of damage, theft, or other loss.

Getting individual extended warranties or protection plans on your camera and equipment can be expensive and limited; it is better and more cost-effective to have everything insured with an AKKO plan.

You can customize your AKKO plan to include coverage for more expensive items or find options for higher incident reimbursement limits. You can also make your AKKO insurance part of a family plan to cover multiple devices across the household.

Protect Your Camera and More with AKKO

By the time theft, loss, or damage occurs, it’s too late to think about insurance. Sign up with AKKO today to get protection for your phone, camera equipment, gear, devices, and more. We offer great rates, the protection you can count on, and clear, affordable pricing, along with fantastic customer service. Give us a call today!