Remote working has been on the rise in recent years, and it is expected to become more popular in 2023. Currently, 16% of organizations are 100% remote. Many people prefer working from home with the claim that they are more productive. While companies were previously against this thought, they now embrace it as it is the easiest way to reduce operational costs and increase productivity.

Well, working from home is fun till your device fails. Maybe your naughty son saw it fit to throw your phone or computer and now you cannot attend that important meeting in the morning.

The question is: Does your corporate device coverage policy allow employees working from home to be insured? It’s important to understand what constitutes personal property under your policy if you have one.

Now, let’s find out all that entails corporate device coverage policy for remote working employees.

What Is Corporate Device Insurance?

Corporate device insurance is a type of insurance that employers provide to cover any devices owned by employees. It includes laptops, computers, gaming consoles, cameras, camcorders, MP3 players, GPS units, smartphones and tablets, and many others. If these items are lost, the policyholder will receive compensation for their loss.

If you are an employer with a corporate device policy in place, you will probably want to ensure that it covers employees working from home. If not, you may expose your company to legal liability for the loss or damage of personal property.

Do All Companies Offer Corporate Device Coverage to All Staff?

As a business owner, you’re probably very concerned about your employees’ privacy and security. But you also need to worry about the safety of your devices.

So, if you work from home, you can expect to be covered under your employer’s corporate device policy. However, some employers offer coverage for employees who work at home, but some don’t.

Different coverage plans are crucial for repair and replacement. Contact your employer if the company you work for doesn’t offer a corporate device policy. Ask them if they have electronic device insurance when you’re working from home.

Chances are they might not have any cover for your device. Well, you can question—were they not informed about the policy? Are there any other ways that they could accommodate your needs?

Maybe they never thought of phone protection plans, and that is okay. Try working out a plan with them to make your remote working flexible with no hiccups.

Benefits of Device Insurance

While remote working is exciting, you need insurance coverage. Below are more benefits of corporate device coverage.

- If something happens to your phone, tablet, laptop, computer, camera, etc., you do not have to worry about paying for repairs. You call your insurer, and they will pay for the repair.

- When you lose your device, you do not need to worry about tracking the item. Some insurers will handle everything for you.

- In case of an injury, it is possible to file a claim with your insurer while using your device.

- If your device gets accidental damage due to a natural disaster, for instance, to your ps5, file for coverage under your device protection plan.

- Did you accidentally damage your device? Then you may be able to document all the details for reimbursement under your policy.

- If you break your device, you will be compensated for the replacement cost.

- Also, if you drop your device, your corporate device cover can help you since dropping a smartphone or tablet is considered accidental.

What Does AKKO’s Corporate Device Protection Plan Cover?

With many embracing remote working, different companies have great deals to protect electronic devices for workers. But what’s the best you can get? AKKO has something for you.

Phone and Device Protection for Businesses

Are you concerned about cracked screens, spills and liquid damages, accidental damage, parts and battery breakdown, theft, vandalism, and more?

AKKO offers a package for corporate device coverage for phones, tablets, and laptops at different prices. It costs $8 for phones and $6 for tablets and laptops monthly.

Whether new, used, refurbished, or any make or model, it has something for every corporate device. Interestingly, when the laptop and tablet parts fail, they get replaced with three-year warranty plans.

Other Devices Under AKKO Protection Plan Cover

AKKO is diverse. So, if you have electronic devices, do not worry. We have something for you!

We offer warranties for lovers of computer games like the ps5 and Xbox. And there is the iPhone, camera, Fitbit, and television protection too.

Is it Possible to Switch from AppleCare to AKKO?

When you have AppleCare cover and find their insurance services unfriendly, it is possible to switch to the AKKO plan. But first, you will have to cancel AppleCare and switch to the alternative service. And they will repay everything owed to you as you cancel AppleCare. So, AppleCare Vs. AKKO? Choose convenience.

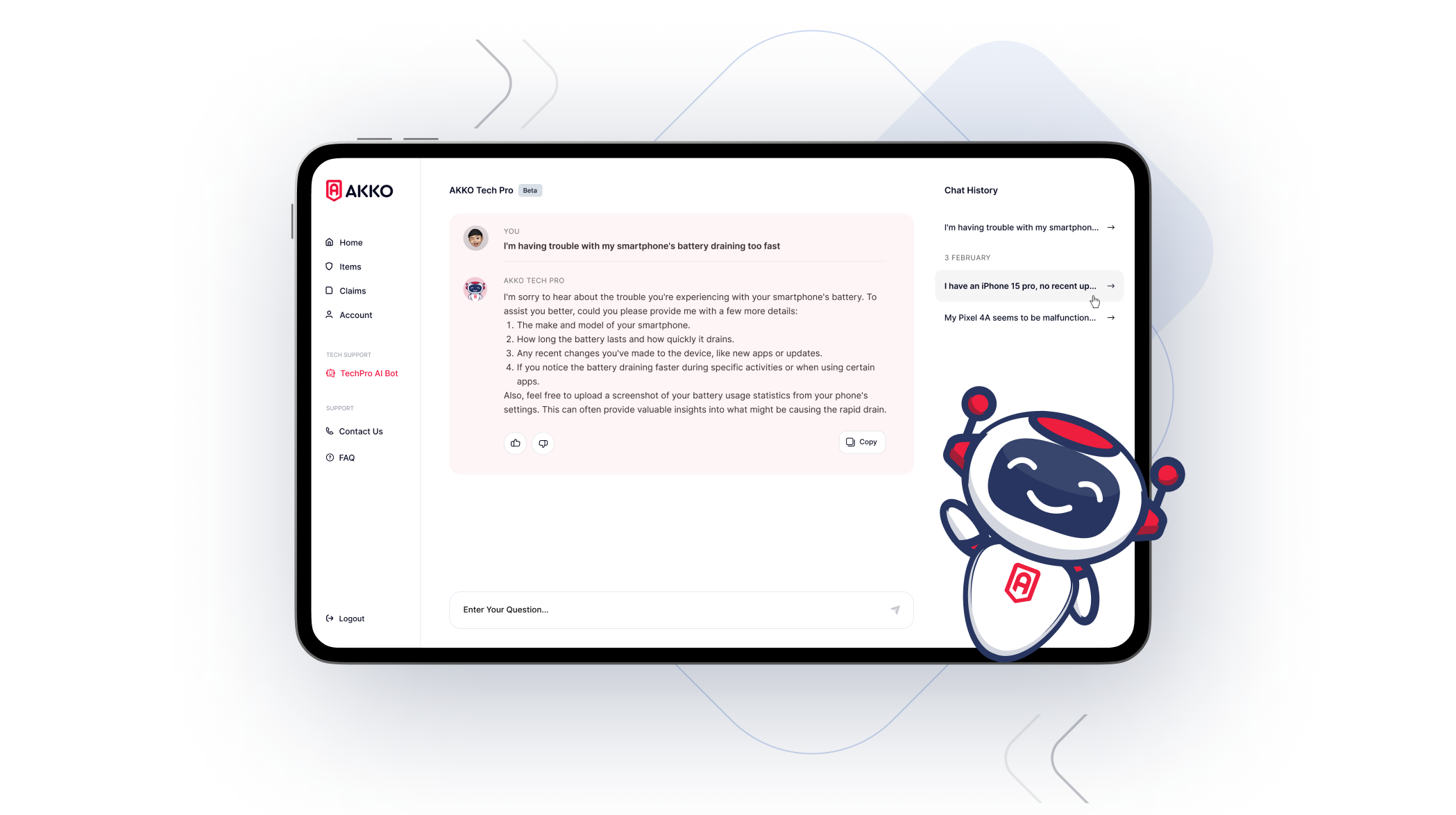

AKKO Claim Process

AKKO aims to make claims fast and stress-free for you!

The claim process entails.

- Login into your account from any of your insured devices.

- File your claim

- You will receive a call from AKKO to ask for any missed out information and direct you to a repair service close to you. It happens within 24 hours of filing a claim.

- When your device is established as repairable, it is taken to a repair shop, where AKKO will send funds for payment. Money will be sent to you or directly to the shop. Cracked screen repair is easy. It is possible in a day.

- In case of replacement—when the device cannot be repaired or was stolen. Expect a payout from AKKO that is equal to the replacement value sent. Or the item is sent to you instead of cash. The choice is yours.

Key Takeaways

While most corporate device coverage plans are viable for employees to use for work purposes remotely, there are some exceptions. A good example is if an employee uses a personal device at home or on vacation, not for work purposes, that device doesn’t fall under the corporate policy’s umbrella. But AKKO has a plan for you—whether it is a business or family plan. Have that personal device insured by AKKO today. It’s fast and easy.