We all want our electronic devices to work as long as necessary to serve our needs. But desktop computers, like most electronic devices, are vulnerable to damage and theft. Replacing or repairing your desktop after damage or theft can cause financial hardship, especially if you live on a tight budget (college student).

The best way to plan for uncertainties is to protect your desktop with a computer insurance plan. Read on to discover if desktop computer insurance is right for you and how it is different from other coverages you may have.

Do Desktop Computers Come with a Warranty?

All new desktop computers come with a manufacturer’s warranty, which usually lasts about a year from the day of purchase. With the manufacturer warranty, desktop repairs or replacement is free should it experience a manufacturer-specified problem in a particular period.

However, manufacturer warranties come with huge disadvantages you must not ignore. For instance, they only cover your desktop against manufacturing defects—not other types of damages or loss.

This means you can’t rely on the warranty when someone steals your machine, or it accidentally gets damaged. Plus, warranties cover issues with the computer’s internal components but not your monitor, keyboard, monitor, and other peripheral devices.

Apart from that, the warranty covers your desktop computer only for a short period, usually a year for most manufacturers. Once the short warranty period elapses, your desktop computer remains vulnerable to damages and theft. For this reason, getting an extended warranty from the manufacturer is so tempting.

But the question remains, is it worth it? While you will get additional protection and a longer coverage with an extended warranty, you will dig deeper into your pocket. Read on to identify an affordable alternative that covers risks a warranty can’t.

Can You Insure a Desktop Computer?

Yes, you can cover your desktop computer with stand-alone computer insurance. The best you can get from a standard warranty is protecting your machine against manufacturer defects. But computer insurance covers theft and all types of accidental damages you can ever think of.

Every day mishaps—cracked screens, liquid spills, or theft—can easily sentence your desktop to death before its time. With computer insurance from AKKO, you get peace of mind that your machine is safe from all accidental damages and theft.

Our computer insurance policies protect desktop computers from vandalism, fire damage, and theft. The policies also provide computer protection from accidental damages, including:

- Cracked screens

- Liquid spills and submersion (e.g., water damages)

- Jammed keyboards

- Monitor failures

The best part about desktop computer insurance is that you can insure your machine and other electronic devices. We offer a comprehensive plan to cover multiple electronics simultaneously if you’re looking for computer insurance, phone protection plans, laptop, and Fitbit insurance. We also provide family insurance plans to protect your devices.

Computer insurance covers more risks than a manufacturer warranty. However, most computer insurance providers don’t cover:

- Corrosion or wear and tear

- Software problems

- Damages as a result of obvious neglect

- Computer viruses

All in all, computer insurance comes with more perks than a warranty from the manufacturer. Let’s look at how to insure your desktop after the warranty expires.

How Do You Insure Your Desktop Computer Once the Warranty Expires?

Most standard warranties only last for a year. When the warranty period elapses, your desktop will be vulnerable unless you protect it with electronic insurance. Similar to expensive properties like cars and real estate with insurance, computer insurance protects your desktop. It prevents costly repairs and replacements in the event of theft and accidental damages.

Desktop insurers like AKKO insure your devices to protect them from everyday mishaps. But there are dozens of insurers in the online world. What makes AKKO unique and the right option for you?

Affordable Insurance Plans

For just $15 monthly, you forget about desktop theft and accidental damages. In addition to protecting your desktop, you can protect your phone plus 24 more electronic devices at the same price. In short, you protect up to 26 electronics at just $15 per month. As a result, AKKO desktop insurance is the protection plan you will ever need.

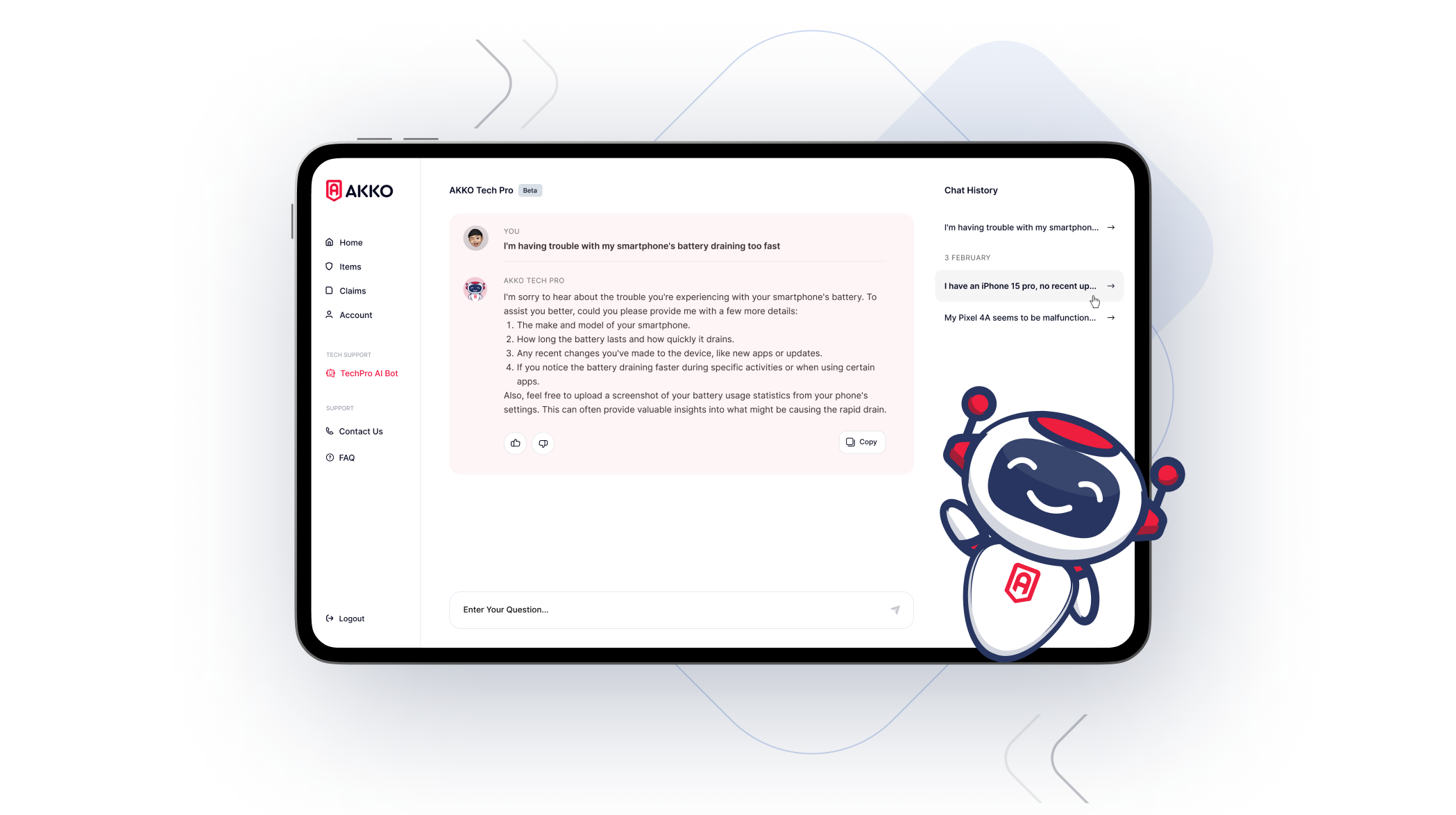

Making Insurance Claims is Super Simple

With our $15 per month plan, all your insured devices are under one policy instead of being scattered in different insurance plans from multiple providers. For this reason, making an insurance claim is super simple. We process claims fast. Depending on the nature of your claim, we process it within 24 hours.

The best part is that your rates will never go up no matter how many claims you make.

AKKO Desktop Insurance Covers All Accidental Damages

Our insurance plan covers all accidental damages and theft, unlike standard warranties that only cover manufacturing defects. Our insurance plan protects your desktop computer from:

- Cracked screens

- Liquid spills and submersion

- Accidental damages and malfunctions

- Theft

- Theft from an unattended car through forced entry

Here’s a step-by-step guide to protecting your desktop computer with insurance from AKKO.

Step 1: Visit our sign-up page.

Step 2: Choose the “Everything Protected” plan, which can protect your phone and up to 25 more devices. Within this plan, you can choose between a “Student Rate” or “Adult Rate,” which are $12 and $15 monthly consecutively.

Step 3: Decide whether you will pay monthly or annually. With an “Adult” plan, you save $12 if you choose to pay annually. With a student plan, you save $ 24 if you pay annually.

Step 4: Enter your payment information and register.

After registering, you will provide your device’s information and take a few photos, and that’s it—the devices are now fully protected. You can easily add or remove items when necessary.

After creating an AKKO account, the insurance coverage will begin at 12: 01 a.m. Standard Time where your desktop computer is located. If a risk occurs, it’s easy to claim compensation—repairs or replacements are done quickly.

Protect Your Desktop Computer and Other Electronics With An Affordable Akko Insurance Plan

Desktop computers are an excellent investment. They can last for years with proper care, but once the warranty expires, repair and replacement costs can be a burden in case of theft or damage. To protect your computer and yourself from these risks, you must protect your desktop.

One of the best ways to achieve that is to insure it with AKKO insurance. Under a single plan that is just $15 per month, you can protect your desktop, phone, and 24 other devices. Sign up right now to protect your desktop computer.