Drone insurance is an important part of buying and flying a drone, but not many people know the details about what’s covered. Drones are becoming more and more mainstream, and as the number of drones in our skies increases, so does the likelihood that accidents will happen. But don’t worry; we’ll explain everything you need to know about drone insurance in detail.

If you know anything about drones, then you probably know that they are fun to fly but can also be quite expensive to repair or replace. So, like any other risky hobby or commercial activity, you want to protect yourself financially in case something goes wrong.

Buying a drone is exciting, but getting the right insurance is also critical. This guide will tell you everything you need to know about drone insurance and why it’s so important.

So, What Is Drone Insurance?

Drones are fast becoming a part of our everyday lives. From capturing beautiful shots to helping with disaster relief and even providing internet access, drones have proven to be versatile tools that can be used for many tasks.

But as drones become more popular and accessible, there is a growing need for insurance to protect users from the risks associated with flying these devices. Drone insurance is an insurance policy that covers the damage or loss of a drone. These policies can be purchased by anyone who owns a drone and wants to protect their investment in case of any unfortunate events.

Drone insurance policies provide coverage for losses incurred by drone users in the event of an accident or crash. This type of insurance is designed to protect those who own or operate drones from financial loss in the event that their drone crashes or causes damage to someone else’s property.

Is Drone Insurance Required?

Drone insurance is a relatively new product that has not yet been widely adopted by the drone industry. As a result, there is a lot of confusion about what it is and whether or not you need it. So, is drone insurance required? The answer is that it depends on where you fly your drone. If you’re flying within the U.S., then no — drone insurance is not required by law. The Federal Aviation Administration (FAA) does not currently list drone insurance as a requirement.

However, if you plan on flying outside the U.S., then it’s probably a good idea to have some kind of coverage in place before you take off. And in addition to international travel, there are many other situations where drone insurance may be necessary, including:

- If your drone gets lost or damaged while flying over private property.

- If someone accidentally damages your drone while they’re playing with it (or if they drop it).

- If someone else causes damage to your drone while operating theirs nearby (even if they aren’t at fault).

Do you have any resources if your drone crashes against something while flying high above your home and breaks into pieces? And what if someone sees your drone hovering over their property without permission and shoots it down? Are they liable for damages? The answer is yes if you have drone insurance.

Does General Liability Cover Drones?

Drones are becoming more and more popular, but they can also be dangerous. One of the biggest concerns is the risk of injury to other people. If your drone hits someone or crashes into their property, you could be held liable for any damages. That’s why it’s important to have drone insurance. This type of insurance covers any accidents that happen while using a drone (or other unmanned aerial vehicles).

But does general liability cover drones?

General liability insurance is meant to protect you from injury or damage caused by your business activities. For example, suppose someone trips over a power cable in your office and breaks their ankle. In that case, general liability will help pay for their medical expenses and any lost wages due to the accident.

Unless it happens on work premises, this type of coverage does not include protection against property damage or personal injury that occurs outside of your business operations. So if your drone crashes into someone’s house, causing damage or injury, general liability won’t help pay for any damages or injuries suffered by that person or their family members.

In other words, don’t expect general liability insurance to cover everything associated with flying drones commercially or even for recreational purposes.

Should I Buy Insurance for My Drone?

Drones aren’t cheap. In fact, even the cheapest models will set you back $70 to $400, which gets considerably steeper when you start to add on extra features like a camera. The good news is that there is a type of insurance that can cover your drone! Drone insurance is available and covers many things. While it might sound strange at first, thinking about drone insurance can help take the stress out of one of the more expensive purchases you will ever make.

Drones are being used by photographers, filmmakers, real estate agents, farmers, etc. And while there are many benefits to using a drone, there are also risks involved. Whether it’s damage caused by an accident or theft, there are many things that can go wrong with your drone. And if something does happen, you may be liable for any damages caused by your drone (which can be expensive!).

If you’re thinking of getting a drone or already have one, you might be wondering if it’s worth getting insurance. The answer is yes. Because of the value of your drone and its accessories, it’s vital to ask yourself whether or not you need drone insurance at all. If you fly for fun, then maybe not. But if you use your drone for any sort of commercial reason (no matter how minor), then you definitely should consider insuring it.

Most people don’t think about insurance when they buy a new gadget, but it’s something you should consider, especially given that we also provide family plans for students. With a family plan, if your drone gets in an accident and it’s damaged beyond repair, you will not have to foot the bills for any repairs or replacements costs.

Types of Drone Insurance

If you’re a drone owner, you’ll want to make sure your flying machine is insured. Drone insurance can cover a variety of situations, including damage to your drone, any injuries that happen as a result of your drone, and more.

The most important thing to know about insurance for drones is that there are two main types of policies: liability and hull. The difference between the two is what they cover, who they cover, and how much they cost. Here’s what you need to know about each one:

Liability Insurance

This type of insurance covers accidents that happen while operating your drone. For example, if someone slips on some ice and falls into their neighbor’s yard while looking up at the sky because a drone was flying nearby and hits them on the head with its propellers, you’ll be covered by this policy.

In addition to covering damages caused by drones themselves, it also covers any other property damage that happens on-site. It is sometimes referred to as property damage liability. This form of coverage protects you from liability for any damage you cause to someone else’s property (for example, if your drone crashes into your neighbor’s window).

Hull Insurance (Physical Damage Coverage)

This type of insurance covers physical damage to your drone. It’s especially important if you have an expensive model or one with custom parts that aren’t easily replaced by off-the-shelf parts. It may also cover theft or loss in transit when flying overseas because these incidents aren’t covered under standard homeowner policies. In other words, the hull insurance policy covers the actual drone.

Other Types of Drone Insurance

Commercial Drone Insurance

This type of drone insurance is designed specifically for businesses that use drones on a regular basis to transport goods or services. Commercial drone insurance can be used to protect against liability issues related to the use of drones and any accidents or damages they may cause while in flight. It also covers damage to a drone itself if it is stolen or damaged beyond repair during use by a business.

Insurance for Personal Use Drones

Insuring your own personal drone is often less expensive than commercial coverage because it does not require as many riders or exclusions as commercial policies. However, there are still some limitations on coverage depending on what type of drone you’re flying, where you’re flying it, and what kind of activity you’re involved in when using your drone. For example, suppose you’re flying your drone for recreational purposes only and have no intention of making money from photography or videography. In that case, you might only need basic liability coverage for any potential damage caused by your drone while in flight.

Personal Injury Coverage

Drone operators are generally considered responsible for any injuries their drones cause while in use at events or locations where there are people around who could be injured by a falling drone or its parts. Personal injury coverage will help pay for medical bills and other expenses related to an injury caused by a drone accident.

How Much Does It Cost to Insure Your Drone?

The price of a drone insurance policy may vary depending on what type of drone you own, how often you fly it, and whether or not you have experience flying drones. Different companies can vary greatly in their coverage, so it’s a good idea to check out a few different ones before making a decision about which one to use.

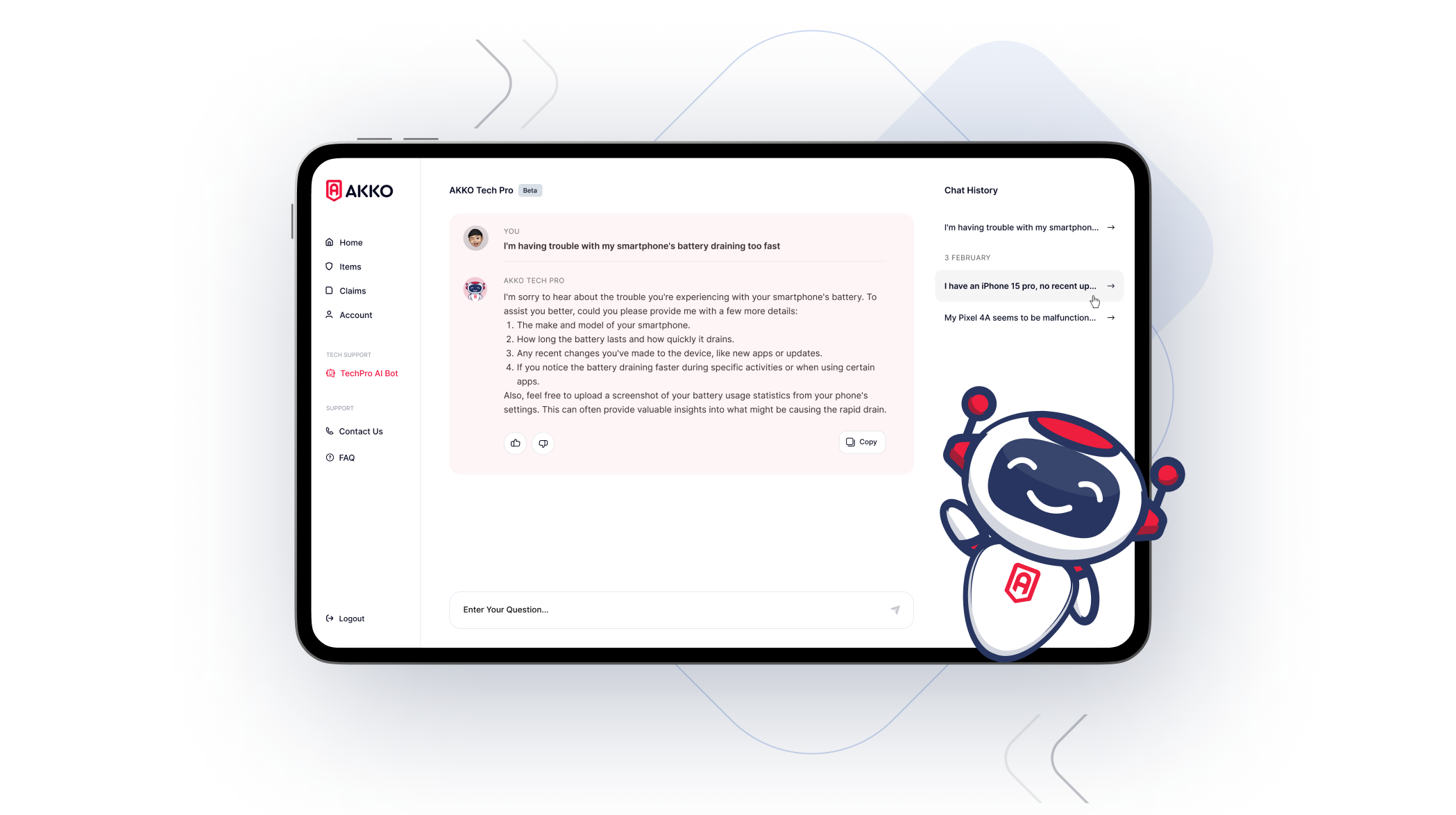

At AKKO, we care for our customers, and we want you to be careful with your money. That’s why we offer a great protection plan for only $15.00 per month, or $14.00 if you pay annually. Students get an even better deal – just $12.00 per month or $10.00 if paying annually.

And it’s not just your drone that gets protected ordinarily, it will include your phone, and you can still add 25 other electronic devices, including TVs and game systems! In other words, you can protect all your electronic devices, including your phone and TV, for only $15.00 per month with AKKO’s “Everything Protected” plan. That’s a much better value than what our competitors charge. In comparisons with prominent firms like AppleCare, SquareTrade, T-Mobile, Verizon, and Geek Squad, AKKO’s supremacy is clearly evident.

What Does Drone Insurance Cover?

Drone insurance is just like any other insurance policy: it’s a financial agreement between you and AKKO that will help you recover from losses in the event of an accident. The main difference between drone and car insurance, for example, is that there are no laws regarding how much you can insure your drone for. There are, however, a number of factors that affect what kind of coverage you should get.

Drone insurance generally covers loss or damage to your aircraft (the drone) as well as its controller accessories — or anything else attached to your drone at the time of the accident. Even so, every insurance provider can be different with their coverage. AKKO is, however, improving the game by offering a wide range of insurance coverage. Our drone insurance plan covers home theft, theft from forced entry, car break-ins, cracks or damages, broken buttons, wires or power supply damage, accidental damage, and spillage.

Insure Your Drone With AKKO

The number of drones in the air is skyrocketing, and it’s not just the hobbyists who are buying them. Drones are becoming a part of our daily lives—and we want to make sure you’re covered if one of yours crashes.

AKKO can help you find drone insurance for your home or business, so you can be rest assured that if an accident happens at your workplace or home, you won’t have to pay out of pocket for replacement parts or repairs.

Ultimately, AKKO’s drone insurance service is worth considering for those looking to safeguard their investment. Our rates are more competitive than more traditional insurance companies, and the coverage is designed to meet the risks involved in operating the actual drone. Get a quote and purchase drone insurance through our website.