You use your electronic devices for a huge variety of purposes. Some are designed just for gaming, while others are made for streaming video content or music. Many devices have the capability to do a wide variety of things, including browsing social media, texting and calling friends and family, checking emails, and more.

Electronic devices such as cell phones, tablets, computers, and smartwatches have become integral to everyday lives in so many ways. In many cases, they are necessary to complete schoolwork, stay connected with coworkers, coordinate with family members, and perform other essential activities related to work, school, and life in general.

Because these devices are so important to your everyday life, it makes sense that you would want to protect them in the event of theft, loss, or accidental damage. After all, electronic devices are significant monetary investments, especially when they are purchased brand-new. The cost to repair or replace these items after damage or loss could be well out of your budget.

What if you could insure your electronic gadgets the same way you can insure your car or home? Luckily, device insurance exists, and it’s helping millions of people save money on repair and replacement costs for their electronics each year.

Accidents happen. A serious issue with your most valuable electronics could mean a significant interruption to your life. That’s why you need to protect your gadgets with high-quality insurance coverage that’s tailored to your needs and your budget with AKKO device insurance.

What Is Electronic Device Insurance?

In general, electronic device insurance is a plan created by an insurance company that covers a specific set of circumstances in which the provider will pay either a portion or the entirety of the repair or replacement cost.

In many cases, a plan is limited to covering a single electronic device, such as a cell phone or laptop. For these policies, the provider will only give compensation for a certain number of claims per year that occur due to a very specific set of issues.

For example, many major device insurance providers will only fulfill one claim within a single 12-month period. These same providers do not include any accidental damage incurred by the device’s owner as a covered loss within the scope of the plan. Instead, their policies are only designed to cover theft, vandalism, and other issues caused by outside parties.

However, there are so many issues that can happen with electronic devices that aren’t related to vandalism, theft, or other problems outside of your control.

What if you accidentally drop your phone or tablet and crack the screen? What if your device suffers from water damage after a spill? What if the device was faulty because of a manufacturer error?

Let’s answer all of these questions and more by diving into some details about AKKO device insurance and what you can expect from an AKKO service plan.

What Does Electronic Device Insurance Cover?

When it comes to the specific coverage details of an AKKO protection plan, your policy is customizable in a number of ways. AKKO offers a phone-only protection plan that protects your smartphone from common issues including internal breakdowns, theft, and accidental damage.

Phone-Only Protection Plan

Unlike many major smartphone insurance providers, including AppleCare, T-Mobile, and Verizon, AKKO proudly protects used and refurbished phones as well as brand-new devices.

Companies that sell new devices and provide phone protection plans have to protect their bottom line. How do they do this? They only cover the phones that have been purchased brand-new from their own stores.

In contrast, AKKO is solely dedicated to protecting phones and other devices. We provide the same high level of protection for all phones, no matter how old they are, what data plan they’re under, or their current condition. Best of all, AKKO users can submit an unlimited number of repair or replacement claims each year as needed.

What if you want the same level of protection for your other valuable gadgets that you have for your smartphone? After all, you depend on your devices to be successful in your job, for your classes, and in your personal life. Luckily, AKKO has you covered with the “Everything Protected” plan.

The “Everything Protected” Plan

With this comprehensive plan from AKKO, you can receive high-quality electronic device insurance for your smartphone, along with comprehensive protection for up to 25 of your most valuable personal items. Once you’ve locked down insurance coverage for your electronic devices, such as your tablet, smartwatch, laptop, or desktop computer, you’ll likely still have several spots left over that you can use to cover other precious items in your possession.

Under the “Everything Protected” plan, you can enjoy coverage for a variety of electronic items, as well as video and photo equipment, music and audio gear, gaming consoles and accessories, non-motorized personal transportation like bikes and scooters, school supplies, and so much more.

You’ll be amazed at how many of the items you use each day could receive reliable coverage under your comprehensive AKKO plan.

Much like the phone-only protection plan, the “Everything Protected” plan covers a wide variety of issues and malfunctions. Coverage can include claims for accidental damage, vandalism, theft, and internal part failure. Users can file unlimited claims for their items, and low deductibles are always guaranteed with AKKO.

How Does It Work?

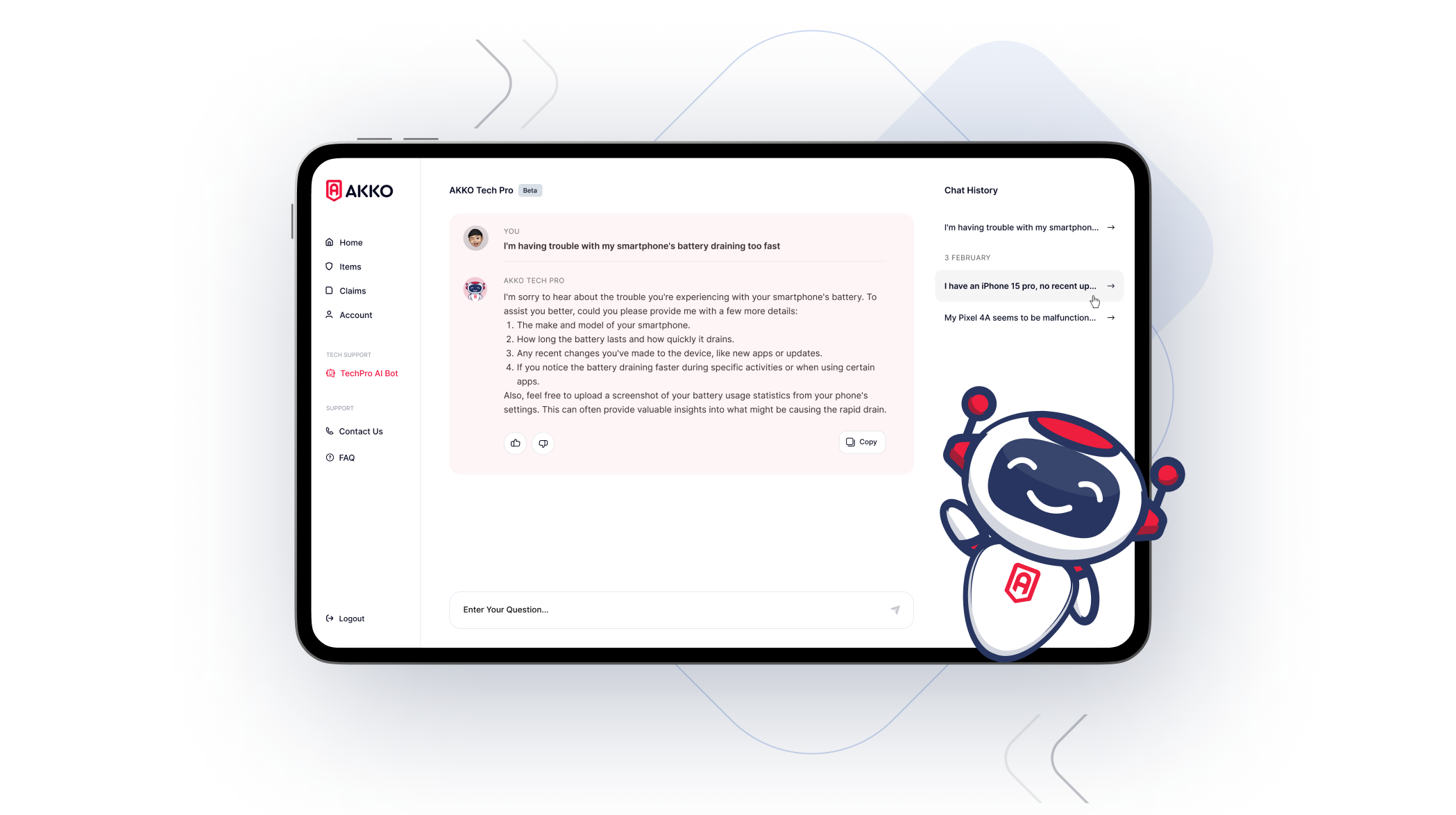

You can set up an electronic device insurance plan with AKKO in just a few easy steps. Register online with your smartphone by downloading the free mobile app, and you can sign up for a plan in minutes from the convenience of your phone.

Once you’ve opted for the phone-only or full protection plan, you’ll be prompted to input some information about your items. Simply snap a few quick pictures of them in their current condition. That’s it! Now, your items are officially covered by your insurance plan and can be protected from any issues that might arise.

If you want to file a claim for replacement or repair costs, you can do it straight through the AKKO app. Oftentimes, AKKO will be able to set up a repair for your smartphone as soon as the same day!

AKKO will pay the repair or replacement provider directly or pay you through a wire transfer or PayPal immediately after the claim has been approved.

What Does It Cost?

AKKO isn’t only known and respected for its excellent electronic device insurance; AKKO users are big fans of the pricing for plans, as well!

For the phone-only protection, you pay no more than $12. In some cases, you can pay as little as $5 per month, depending on the specifications of the phone being covered, whether you’re paying each month or annually, and if you qualify for student pricing.

The “Everything Protected” plan includes coverage for your smartphone and 25 personal items for a low flat rate of $15 per month – this same incredible rate applies, no matter what items you have covered. The price comes out to $14 per month if you opt to pay annually instead of monthly. Students can pay as low as $12 per month (or $10 per month if paid annually).

These prices can dip even lower when you combine coverage for multiple users using a family plan. Plus, AKKO guarantees that deductible totals will never surpass $99. In most cases, they’ve as low as $49 per claim.

Does Homeowners’ Insurance Cover Accidental Damage to Electronics?

What if you already pay for a homeowner’s or renter’s insurance plan? You might be wondering whether your devices could simply be included under those types of coverage.

The answer is yes – most homeowner’s insurance plans will include options to claim smartphones, laptops, tablets, and other gadgets, as well as non-electronic valuables that can be included in AKKO’s “Everything Protected” plan.

However, it’s important to keep in mind that most coverage for these items within a renter’s or homeowner’s insurance plan will be more limited than a dedicated device coverage plan.

Plus, these plans will likely only cover theft or damage incurred by a natural disaster, which leaves you paying out of pocket for common problems like internal malfunctions or accidental damage.

The Best Electronic Device Insurance You Can Find!

Today’s electronics can be as expensive as they are useful. That’s why it’s so helpful to invest in a high-quality gadget insurance plan.

Even with a great device protection plan from AKKO, it’s still important to be careful with your devices and take the necessary precautions to avoid theft, vandalism, and accidental damage.

But, when life happens and you’re left with a broken smartphone or a stolen laptop, you (and your wallet) will be happy that you have a great gadget insurance provider to lean on.

With coverage available for your smartphone as well as 25 of your most valuable items at just $15 per month or less, you won’t find a better value out there. Get in touch with the team at AKKO today to learn more.