As technology continues to play an increasingly important role in our daily lives, it’s become more important than ever to protect our electronic devices. Unfortunately, many people assume that their renters or homeowners insurance policy will provide adequate coverage for their electronics. However, in many cases, this is not the case.

In this post, we’ll explore why renters and homeowners insurance policies may not provide adequate coverage for electronics, and what you can do to protect your devices.

What does Renters & Homeowners Insurance Cover?

Renters and homeowners insurance policies are designed to provide coverage for your personal property in the event that it is damaged or stolen. However, the coverage provided by these policies may be limited when it comes to electronics. Most policies will cover your electronics in the event that they are damaged or stolen due to a covered peril, such as a fire, theft, or vandalism. However, the coverage limits for electronics may be much lower than you would expect.

According to the National Association of Insurance Commissioners (NAIC), the average renters insurance policy provides up to $35,000 in coverage limits, for the average persons’ $30,000 worth of belongings. Homeowners insurance policies typically offer higher coverage limits, but these may still be inadequate for those with expensive electronics. Additionally, many policies may have exclusions or limitations for certain types of electronics, such as smartphones, laptops, or high-end gaming equipment.

Why Renters & Homeowners Insurance May Not Be Enough

There are several reasons why renters and homeowners insurance policies may not provide adequate coverage for electronics.

- Home owners policies typically have a high deductible on personal electronics. Therefore, if a phone is stolen, it might not hit the homeowner policy’s deductible, despite the high cost of a smartphone (over $700) or a screen crack repair (up to $379).

- Second, some policies may have exclusions or limitations for certain types of electronics. For example, your policy may exclude coverage for smartphones or laptops, or may limit coverage for high-end gaming equipment. This means that even if your policy does provide coverage for electronics, it may not cover all of your devices.

- Finally, renters and homeowners insurance policies may not cover damage to your electronics that occurs outside of your home. For example, if you drop your smartphone while out in public, or if your laptop is stolen from your car, your policy may not provide coverage.

Why You Should Consider Additional Coverage

Given the limitations of renters and homeowners insurance policies when it comes to electronics, it’s important to consider additional coverage to protect your devices. Electronic device insurance, also known as gadget insurance, can provide coverage for accidental damage, theft, or loss. These policies typically have higher coverage limits and fewer exclusions than renters or homeowners insurance policies. For example, a gadget insurance policy may cover the full cost of repairing or replacing your smartphone or laptop, even if it was damaged or stolen outside of your home.

Another advantage of gadget insurance is that it can be tailored to your specific needs. For example, you may be able to choose the level of coverage you want, such as coverage for accidental damage only or coverage for accidental damage, theft, and loss. You may also be able to choose a deductible, which is the amount you pay out of pocket before your insurance kicks in.

In addition to gadget insurance, there are other options for protecting your electronics. For example, you may be able to add a rider to your renters or homeowners insurance policy specifically for your electronics. However, these riders may still have limitations and exclusions, so it’s important to read the fine print carefully.

What Can You Do to Protect Your Electronics?

If you’re concerned about the limitations of your renters or homeowners insurance policy when it comes to electronics, there are several steps you can take to protect your devices.

- Purchase Additional Coverage: One option is to purchase additional coverage specifically for your electronics. Many insurance companies offer electronic device insurance, which can provide coverage for accidental damage, theft, or loss. These policies typically have higher coverage limits and fewer exclusions than renters or homeowners insurance policies.

- Read Your Policy Carefully: Another important step is to read your renters or homeowners insurance policy carefully to understand what is covered and what is not. If you have questions or concerns, don’t hesitate to reach out to your insurance agent for clarification.

- Keep Receipts and Documentation: To make the claims process easier in the event of damage or theft, it’s important to keep receipts and documentation for your electronics. This will help ensure that you can provide proof of ownership and value to your insurance company.

- Take Precautions to Protect Your Devices: Finally, it’s important to take precautions to protect your devices from damage or theft. This can include using protective cases, avoiding leaving your devices in visible areas of your home or car, and using tracking software to locate lost or stolen devices.

In Conclusion

While renters and homeowners insurance policies can provide valuable coverage for your personal property, it’s important to understand their limitations when it comes to electronics. By taking steps to protect your devices and purchasing additional coverage if necessary, you can ensure that your electronics are adequately covered.

By taking steps to protect your devices and purchasing additional coverage if necessary, you can ensure that your electronics are adequately protected. In today’s world, where technology plays a vital role in our daily lives, it’s more important than ever to take these steps to safeguard our devices.

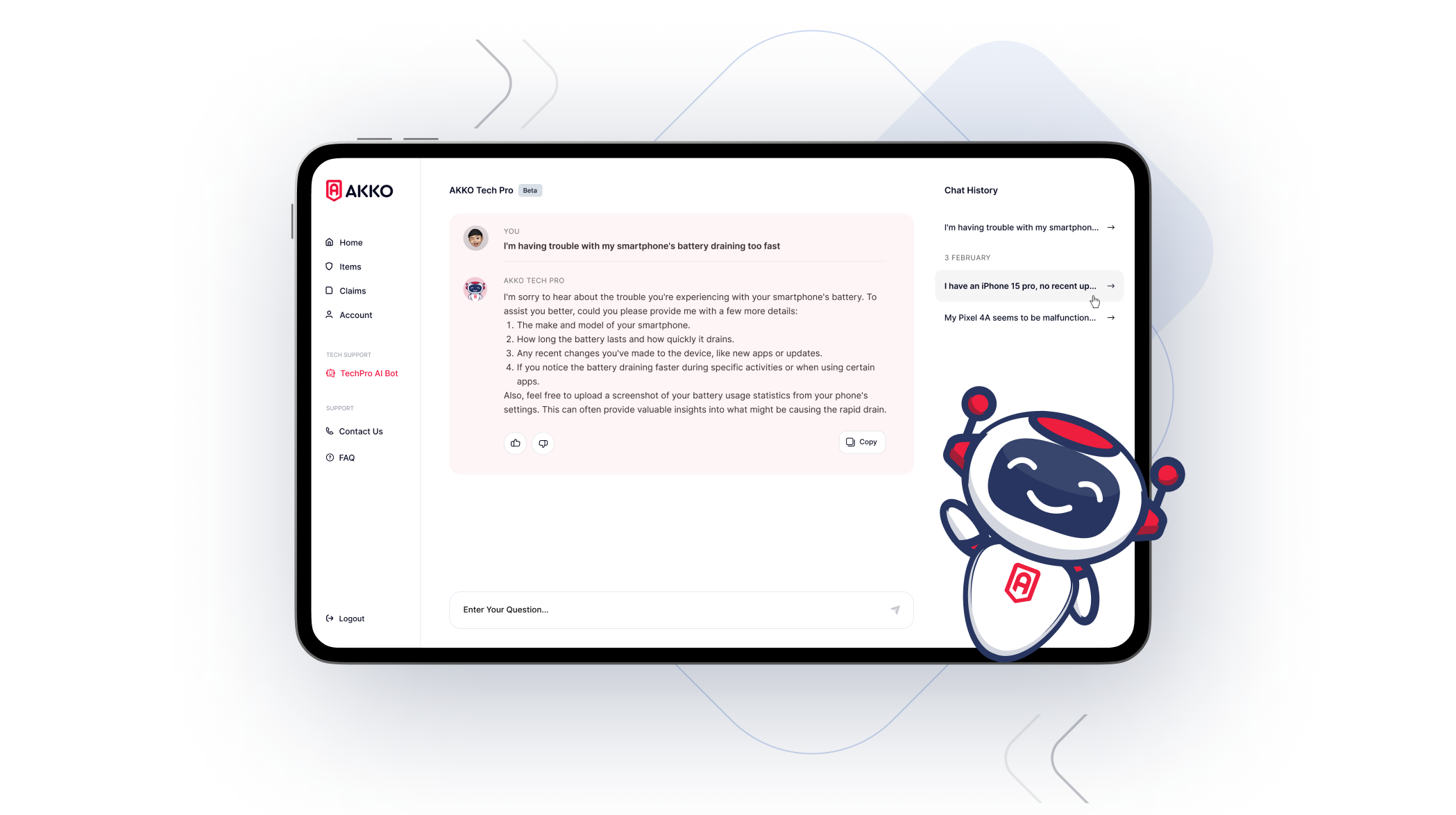

At AKKO, we understand the value of your electronic devices and the role they play in your life. That’s why we offer affordable and comprehensive device insurance coverage for smartphones, laptops, tablets, gaming consoles, and more. With our policies, you can have peace of mind knowing that your devices are protected from accidental damage, theft, or loss, no matter where you are.

Don’t wait until it’s too late to protect your electronics. Contact AKKO today to learn more about our device insurance coverage and how we can help you safeguard your valuable devices.