People can disagree about many things in this world, but at least one thing’s for sure: Smartphones have gotten wickedly expensive.

The new iPhone 13 Pro starts at $999 and ranges all the way up to $1,599, while Samsung’s Galaxy Z Fold 3 can cost up to $1,899. Those are some eye-popping figures, but that’s what it costs to be on the cutting edge of modern technology.

With price tags that high, it’s natural to consider smartphone financing; all the major manufacturers, carriers and retailers offer it, often with 0% interest (albeit with limitations). After all, if you can’t pay it off right away, you’re certainly better off financing your smartphone than adding it onto your credit card bill at a sky-high interest rate.

There are a lot of options for financing a smartphone, and we don’t want to make your eyes glaze over by describing them all, so let’s just operate under the assumption that you can finance your phone with 0% interest over a period of 24, 36, or 48 months.

Note: Some smartphone financing options, especially retailer credit cards, will charge you deferred interest at a percentage that can range well into the 20s if you’re not able to pay off the balance completely within a certain time period, so that’s something to keep in mind, but it’s not a dealbreaker if you’re sure you can make the payments in time. Keep in mind that if you do end up paying that deferred interest, it’s going to be on the whole amount, not just what you owe when 24 months is up.

With all that in mind, let’s take a look at the pros and cons of smartphone financing, and how it can affect your financial circumstances.

Pros of Smartphone Financing

1. You can afford a bigger, cooler, newer phone.

Not everyone has an extra thousand bucks laying around to spend on a phone upgrade. Studies have shown that upward of 30% of Americans would have trouble coming up with $400 for an unexpected emergency expense, which really puts a $1,000 phone in perspective.

Of course, while you may not have the money to buy a cool new phone now, you may reasonably have faith in your ability to make that money over the next two to four years, and when you walk out of that (proverbial) store with your shiny, new phone, you’re only going to have spent about $25 to $40 right now.

That’s a powerful feeling. Just don’t forget that it comes with a four-figure obligation.

2. You can build credit.

For younger consumers, people who don’t have extensive credit histories, or people who need to improve their credit, smartphone financing can be an easy way to establish credit – which will come in handy when you need to finance something far bigger in the future, like a car or a house.

Making all your payments on time will boost your credit, allowing you to qualify for future loans, and since the monthly amount is fairly modest for a phone, it’s a fairly easy path to building up some credit history. Of course, if you don’t make the payments on time… that’s another story.

3. You may be able to earn rewards.

When you use a credit card – particularly from a retailer – you may be able to earn rewards on your purchase while still paying that 0% interest, meaning that you actually end up paying even less than the purchase price. You may also be able to finance your phone with a new credit card; it’s not unusual to find offers with 12 months of 0% interest as well as cash-back benefits.

Cons of smartphone financing

1. You can get locked into your carrier on a contract.

If you choose smartphone financing through your carrier, as many people do, you’re stuck with them on a contract, often for a two-year period. If you want to switch carriers, that means you’ll have to cancel your contract (which may incur a fee) and pay off the remaining balance on the phone – exactly the lump-sum spending you were avoiding by financing your phone in the first place.

If you’re able to buy your smartphone outright or otherwise bring your own device, you gain a degree of flexibility and control over your service that you won’t have if you finance.

2. You may spend beyond your means.

Ultimately, the bill comes due. You’re going to pay $1,000 for that $1,000 phone, whether you do it today or over the next couple years. The manufacturers, carriers and retailers all understand the psychological effect of letting you walk away with a $1,000 piece of hardware for only $40 today. You don’t feel like you just spent a grand, but you did. And with a practically unlimited range of things you can finance with minimal up-front payments – computers, TVs, furniture, exercise bikes, cars, etc. – your debt can add up fast.

If, on the other hand, you have to spend all that money on the spot, you’re naturally going to spend more cautiously. Maybe you’ll put off your upgrade a few months longer to save up. Maybe you won’t buy the most expensive phone. Maybe you’ll shop for a better deal.

3. Your credit score could be affected.

Every hard credit inquiry shows up on your credit score, and this one will be no exception. The inquiry for smartphone financing may be only a small and temporary hit to your credit, but it is one nonetheless.

More concerningly, the amount itself can affect your credit too, especially if you don’t have a lot of open credit. Your credit utilization rate – the percentage of your available credit that you’re using – can rise quite a lot from the addition of an extra $1,000, and if it remains high, that’ll cause your credit score to decline steadily over time.

Of course, failing to make the payments on time will damage your credit too.

4. Things get dicey if you break your financed phone.

The process after you break your (uninsured) phone may vary depending on the terms of your finance or lease agreement, but you’re likely to be stuck with one of two unsavory options: paying off the remaining balance on the phone or buying another phone while still making the monthly payments on the last one.

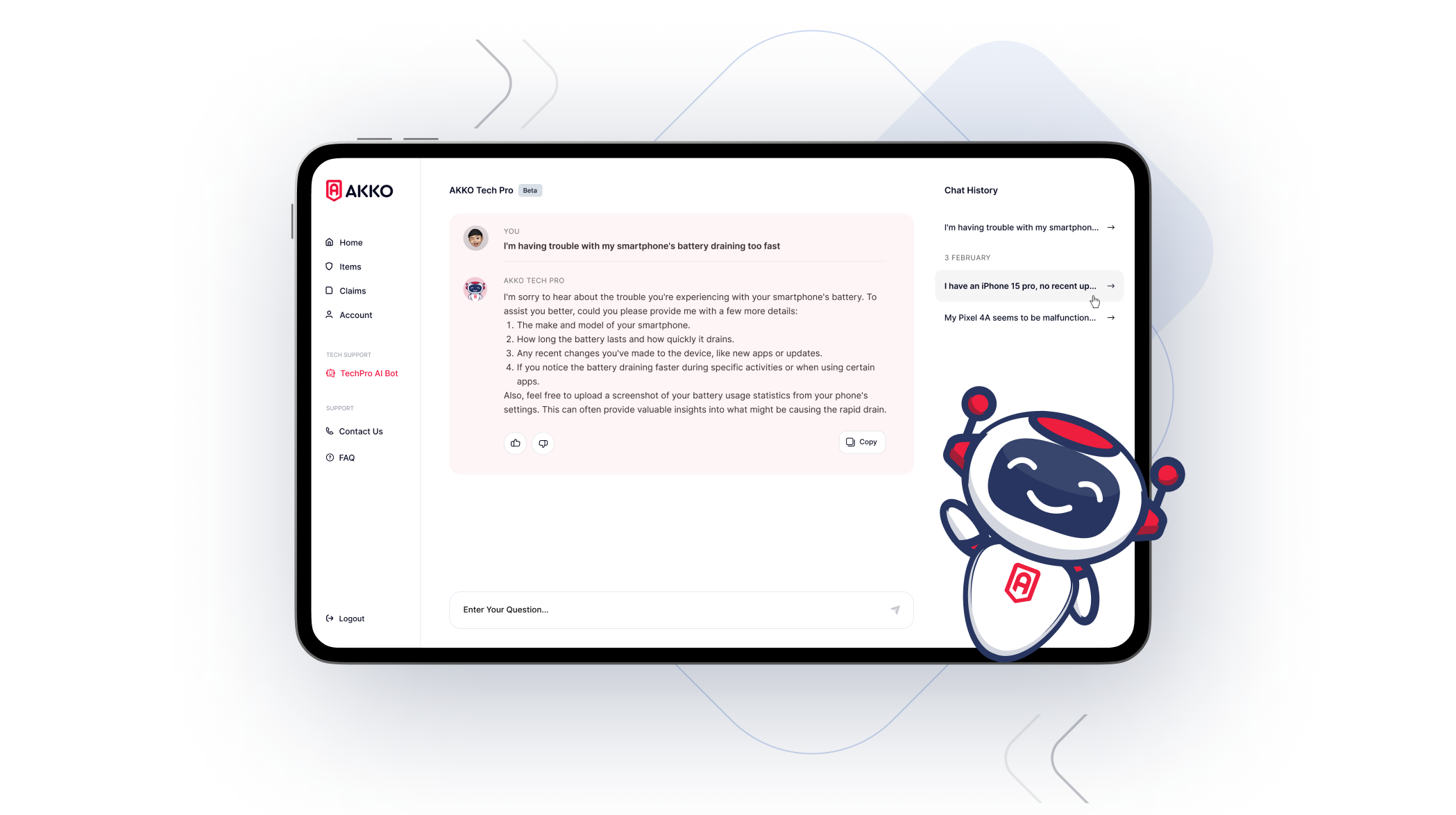

That’s a tough situation to get into. Fortunately, you can head off that risk and protect yourself from large, unforeseen expenses resulting from damage, theft, and mechanical failures. For a flat $15 a month, you can protect your phone as well as 25 of the other valuables you can’t live without – computers, tablets, TVs, smartwatches, sports gear, musical instruments, and much more – with AKKO.

Try us out for the first month for just $1 with code SAVE and enjoy the peace of mind that comes with knowing that AKKO’s got you covered!