Whether you are a busy professional, college student, or a casual PC gamer, you likely depend on your laptop every day. But are you really giving it the protection that it deserves?

Many consumers believe that their laptops are covered through the manufacturer warranty or with a supplemental plan like AppleCare. While these protections are certainly better than nothing, they do not offer nearly as much coverage as AKKO’s laptop insurance!

In the event of an incident, you could be left paying a huge deductible to get your laptop repaired. Even worse, you might have to pay out of pocket to replace or repair your device if the damage is not covered by your warranty.

Fortunately, a comprehensive protection plan will cover lots of things that manufacturer warranties will not. This includes things like laptop theft, cracked screens, and other forms of accidental damage.

Below, we’ll take a closer look at laptop insurance so that you can choose the right protection to cover the cost of repairs for your devices.

Does the AKKO Plan Cover Laptops?

Yes, the AKKO protection plan covers laptops. With our plan, you can replace alternative forms of laptop insurance and roll all of your protections into one of our comprehensive family plans.

In addition to laptops, AKKO plans cover:

- Phones

- Tablets

- Smart watches

- TVs

- Monitors

- Cameras

- Tripods

- Speakers

- Electronic music instruments

- Headphones

- Video game consoles

- Clothing

- Backpacks

- Coffee makers

- Microwaves

- And more!

When you sign up for one of our phone protection plans, you can protect one cellular device and up to 25 additional items.

The base coverage amount per claim is $2,000. However, you can upgrade your per-claim coverage to as much as $10,000!

With our laptop protection plan, you can protect all of your valuable devices from theft, cracked screens, and whatever else life throws at you.

Does It Include Desktop Computer Insurance?

Yes, desktop computers are some of the many devices that are covered by AKKO’s laptop insurance. The AKKO plan protects your desktop computer from all sorts of incidents, including spills, cracked screens, drops, theft, and vandalism.

In short, AKKO’s desktop and laptop protection plans are some of the most comprehensive protection plans available!

The AKKO plan also features an affordable deductible to replace damaged or stolen items, including your desktop computer.

If you need to file a claim on your desktop computer, the deductible is only $99. That amount drops to a meager $49 if you have a student laptop insurance plan. This plan includes a $2,000 limit per incident, which means that you will have plenty of funds to replace your damaged or stolen desktop computer.

Unlike protection plans through carriers like Verizon or T-Mobile, there are no annual claim limits. This means that you can file as many legitimate claims as needed per year. If you have the unlucky experience of damaging your desktop or laptop 5 times in a single year, you can file an AKKO claim for each incident.

How Much Does Laptop Insurance Cost?

AKKO’s laptop protection plan is extremely affordable. Our multi-device family plan starts at just $15 per month for adults and $12 per month for students. This plan includes phone insurance and protection for up to 25 additional devices, such as your laptop.

The base plan provides full accidental damage and theft coverage and a $2,000 reimbursement limit.

If you would like to upgrade your coverage, all you need to do is sign up for the base plan. Once you have created an account, simply access the billing section of your profile and select a higher coverage option. We find that $2,000 is adequate for most of our consumers, while $3,000-$5,000 is the most popular supplemental coverage option. However, we offer electronic protection coverage as high as $10,000 per incident, which is a great option for individuals who have lots of top-end electronics.

Regardless of how much laptop insurance coverage you need, your deductible will remain at $99. For students, this amount is reduced to $49. Our phone-only plans have a deductible as low as $29 and only cost $6 per month for coverage.

All of these options offer a minimum of $2,000 of coverage per incident and include no annual filing limits.

Which Insurance is Best for Laptops?

Generally, $2,000 of coverage is plenty of protection for most laptops. However, if you own an expensive device, such as a gaming computer, then we recommend upgrading your laptop insurance to a higher coverage amount.

Adding a few thousand dollars of coverage will only cost you a couple of bucks per month on your premium.

If you frequently carry multiple electronics together in the same bag or pack, you may want to explore more comprehensive coverage. Let’s say that you are wearing your $1,000 smartwatch and carrying your backpack while walking to work. Your backpack is valued at $250, and it contains a $1,500 laptop and $1,000 cell phone. During your walk, you are the victim of theft and are deprived of all four items.

While AKKO’s protection plan has no annual claim filing limits, the base plan only provides $2,000 of coverage. Even though you were deprived of four separate insured items that totaled $3,750 in value, the base plan would reimburse a maximum of $2,000 per incident. Since all items in our scenario were taken during the same event, you would be unable to file separate claims.

That is why many of our clients up their coverage to between $3,000 to $5,000 to ensure that they are protected in a “worst case” scenario.

AKKO Family Gadget Insurance Plan

The AKKO Family Gadget plan is one of the most comprehensive coverage options on the market today. It offers plenty of protection at an incredible value.

For just $15 per month, you can obtain laptop protection, protect your phone, and cover up to 25 total gadgets. This means that you can provide coverage for your wearable tech, tablets, desktop computers, and even many appliances.

If you are looking for all-in-one laptop protection at an unbeatable price, then the AKKO Family Gadget plan is a clear choice.

Does Laptop Insurance Cover Theft?

Manufacturer warranties and most laptop insurance plans do not cover theft. Fortunately, AKKO’s laptop protection plan is no ordinary plan. If you lose one of your belongings, you’ll need to evaluate the situation to determine whether it qualifies as theft or what’s called “mysterious disappearance” (i.e., you simply misplaced your belonging and have no idea where it went).

If you are filing a claim for a stolen laptop, demonstrating the location timeline is not necessary. With that said, if your laptop or other items are stolen from within your vehicle, you must demonstrate that it was locked and that the intruder gained access via forced entry. The AKKO plan does not cover theft from motor vehicles if your car was left unlocked.

You must also include a copy of a filed police report with any theft claims, including vehicle burglary-related incidents.

Do Laptops Come with a Warranty?

Most laptops come with a limited manufacturer warranty. This warranty typically lasts for 12 or 24 months, depending on the policy of the manufacturer. Warranties do not offer nearly as much protection as laptop insurance.

In fact, many users find that they cannot get their laptops replaced or repaired when attempting to file a warranty claim. This is because most manufacturer warranties are filled with loopholes that the providers use to avoid honoring their policies.

If your goal is to protect your devices, laptop protection through AKKO is a much more reliable option.

Warranty vs. Insurance

Warranties are provided directly by manufacturers. When it comes to laptops, a manufacturer’s warranty generally covers things like mechanical failures and equipment malfunctions. Warranties serve as a promise that the company will replace or repair items that malfunction due to defects in the production process.

On the other hand, laptop insurance is a post-purchase coverage option that can be used to protect your personal property. It covers the cost of repairs due to accidental damage.

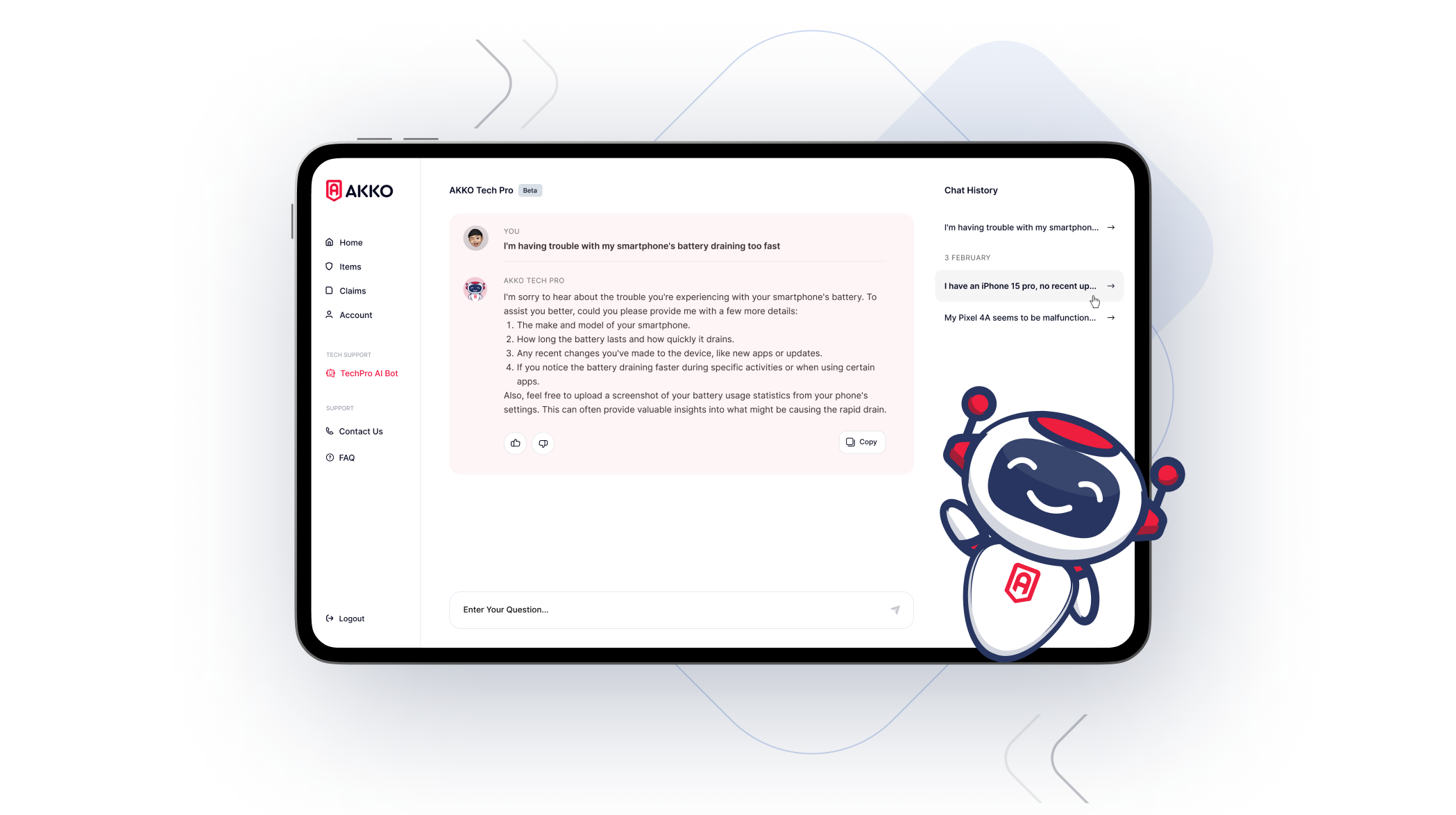

When you file a claim on your AKKO laptop protection plan, we get to work on assessing your claim so that you can get your device repaired fast.

Benefits of AKKO Gadget Insurance Over a Warranty

The AKKO protection plan offers some distinct benefits over standard warranty options. If you would like to see how we stack up against some of the top warranty and phone service insurance providers, check out these breakdowns:

What you will find is that our services consistently outperform the competition. AKKO’s protection plan offers greater protection and more coverage options. Plus, our pricing simply cannot be beaten! We can protect your phone, laptop, and other electronics for just $15 per month!

In addition, AKKO’s plan protects you from incidents of theft. Many protection plans, such as Geek Squad or Verizon’s Home Device Protection, do not cover theft. If your laptop is stolen, then you will be left to replace it yourself —unless you have AKKO’s laptop protection plan, that is.

Protect All Your Devices With AKKO!

Do not wait until disaster strikes to think about laptop insurance. Sign up for an AKKO plan today and protect all of your devices. We offer great rates, reliable protection, upfront pricing, and exceptional customer service!