If you tend to lose a lot of things, having phone insurance is a great way to feel like you’re in control. Whether you prefer Android, iPhone, or Windows devices as your daily drivers, your mobile devices can be a big investment. Phone insurance can add another layer of protection for you.

While it’s not mandatory for most people, it is a good idea for those who don’t want to pay full price for their devices again. So here are some essential tips for applying for cell phone insurance for used phones and other devices.

Can you get insurance on a used phone?

Yes, you can get protection on a used phone. If you’ve purchased your phone from a third-party seller, they might have already insured it. In addition, some carriers, such as AKKO, offer protection plans for used phones and devices.

AKKO offers protection plans for used devices and a wide range of plans that cover loss, theft, accidental damage, and more. For instance, if you want to get the most out of your protection plan, it’s best to purchase the Everything Protected AKKO Plan. The plan covers one phone and all your electronic devices, up to 25 items, for only $15 per month.

How do I get a warranty on a used phone?

If you’re buying a used phone, it’s important to find out if the seller has any warranty. If the seller doesn’t have any warranty and your device breaks down after a few months of usage, you won’t be able to get it repaired or replaced.

There are a few ways you can go about getting a warranty for your used phone:

- Ask the seller if they have any warranty on the phone. If they don’t, ask them if they are willing to give you one from another supplier.

- If they don’t want to give you a warranty, then ask them to at least reduce the phone’s price. You can also ask about the warranty period for your specific device or brand before making any purchases. If you are buying an unlocked phone, then you should be able to get a replacement from the company that made it if anything goes wrong with it.

- Some mobile phone companies offer warranties with their new phones. You’ll need to contact them directly to find out if they also offer this service for used phones.

- You can also look for a warranty from a third party. This may be the best way to go about it if you don’t want to worry about finding out if your phone’s manufacturer offers one. Third-party warranties are available almost everywhere, ranging from a few months to two years.

By following the above steps, you should be able to find phone insurance for used phones that will cover your phone for a reasonable price. You may also want to consider purchasing protection on the device, which may be available through your carrier or some third-party companies. If you do this, read the fine print first to know its coverage.

Can I insure my electronics?

Yes, you can insure your electronics. It’s a good idea to do so because they are often more expensive than other items in your home. You should keep some things in mind when purchasing a protection plan for electronics. If you have multiple devices like laptops or tablets, you may want coverage on them.

Another thing to consider is whether or not a manufacturer’s warranty covers your electronics. If they are, it’s probably not worth getting insurance because if something happens to your device while it is under warranty, the company will fix it for free.

You may also want to consider whether or not you need coverage for accidental damage. Again, this is a good idea in most cases because it covers things like dropping your phone in the toilet or spilling coffee on your laptop.

If you decide to get insurance, purchasing it as soon as possible is best. The longer you wait, the more expensive your policy will be because of the increased risk of theft or damage.

How does device protection work?

Device protection is usually a kind of add-on to your mobile phone contract. You can purchase it from the same place you buy your contract, or an insurance company will contact you about the policy after purchasing it. If you decide to get coverage for accidental damage, two types of device protection are available: replacement and repair.

- Replacement protection covers the cost of replacing your device with a new one if it’s lost, stolen, or damaged beyond repair.

- Repair protection covers the cost of repairing your device if it breaks or malfunctions within the coverage period.

You’ll need to report the incident to your insurance company if your phone, laptop, or tablet is stolen or damaged. This can be done online or over the phone by providing proof of purchase and answering a few questions about what happened.

If you have cover for accidental damage, this will also cover theft, so you won’t need to pay anything extra if someone steals your device.

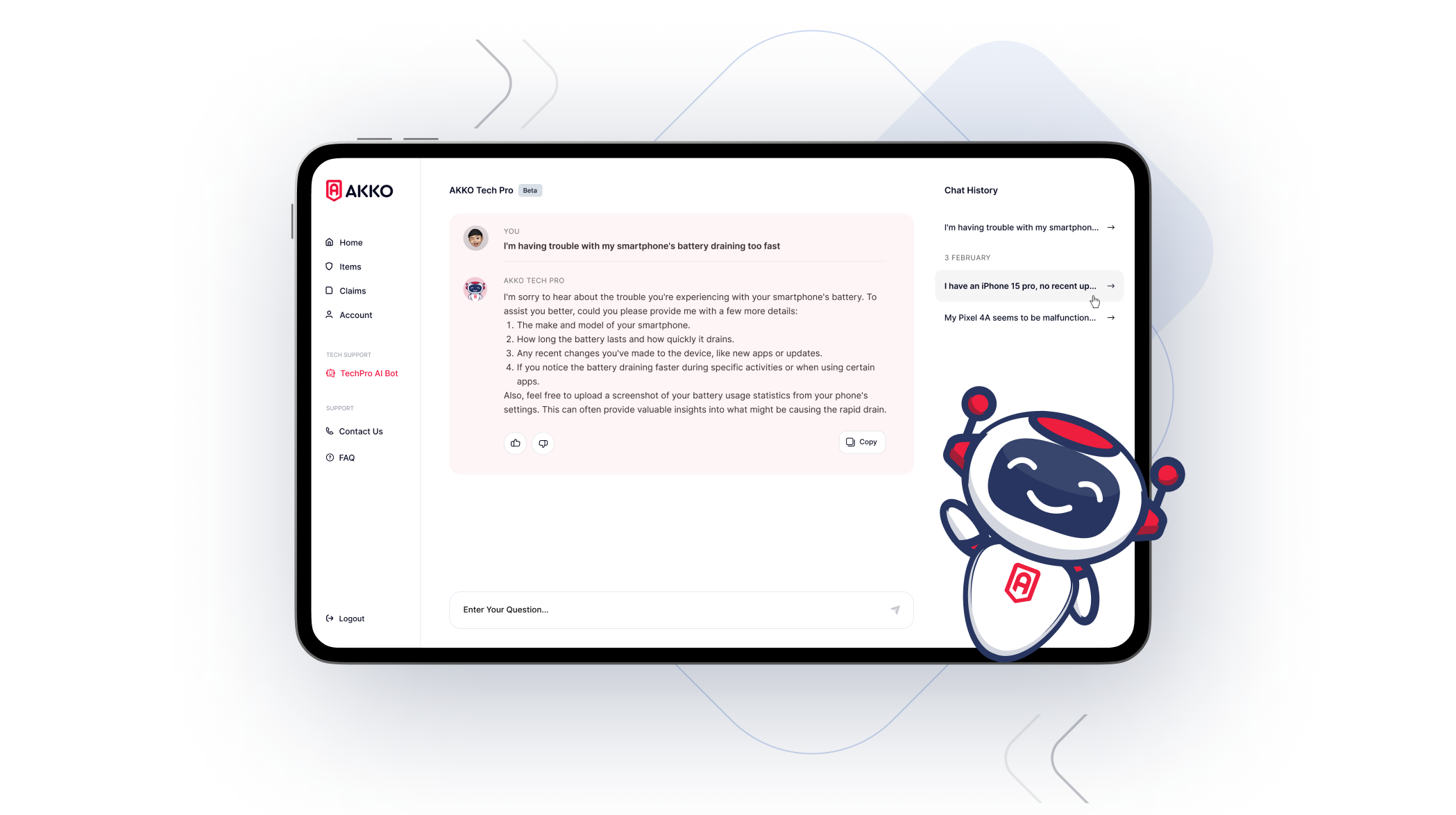

AKKO Protection Plan

AKKO’s protection plan offers a range of repair and replacement protection for your mobile devices. Whether you have a smartphone, tablet, or laptop, the policy will cover the cost of repairs if your device is damaged or stolen. You can also opt for an accidental damage cover, which covers drops and spills from everyday use.

The policy includes a 10-day repair guarantee, so if the repairer can’t repair your device within this time, AKKO will replace it with a new one. You also have the option to renew your policy every year. As with most protection plans, an excess applies if you make a claim.

Conclusion

There are plenty of ways to get phone insurance for used phones. But like any insurance policy, you have to weigh the cost of the premium against potential risk. If you’re willing to commit to a high-value phone and shell out a few bucks per month in case of loss or damage, this type of insurance is right for you. Make sure your carrier allows multiple phones on the same account, or you’ll be able to add the new device.

If you need phone insurance for used phones and devices, AKKO’s protection plan is here to help. We offer a range of coverage options at affordable rates, so you can be sure your device is protected without breaking the bank. If you have any questions about our coverage or want to get a quote, please write to us, and we’ll get back to you right away.