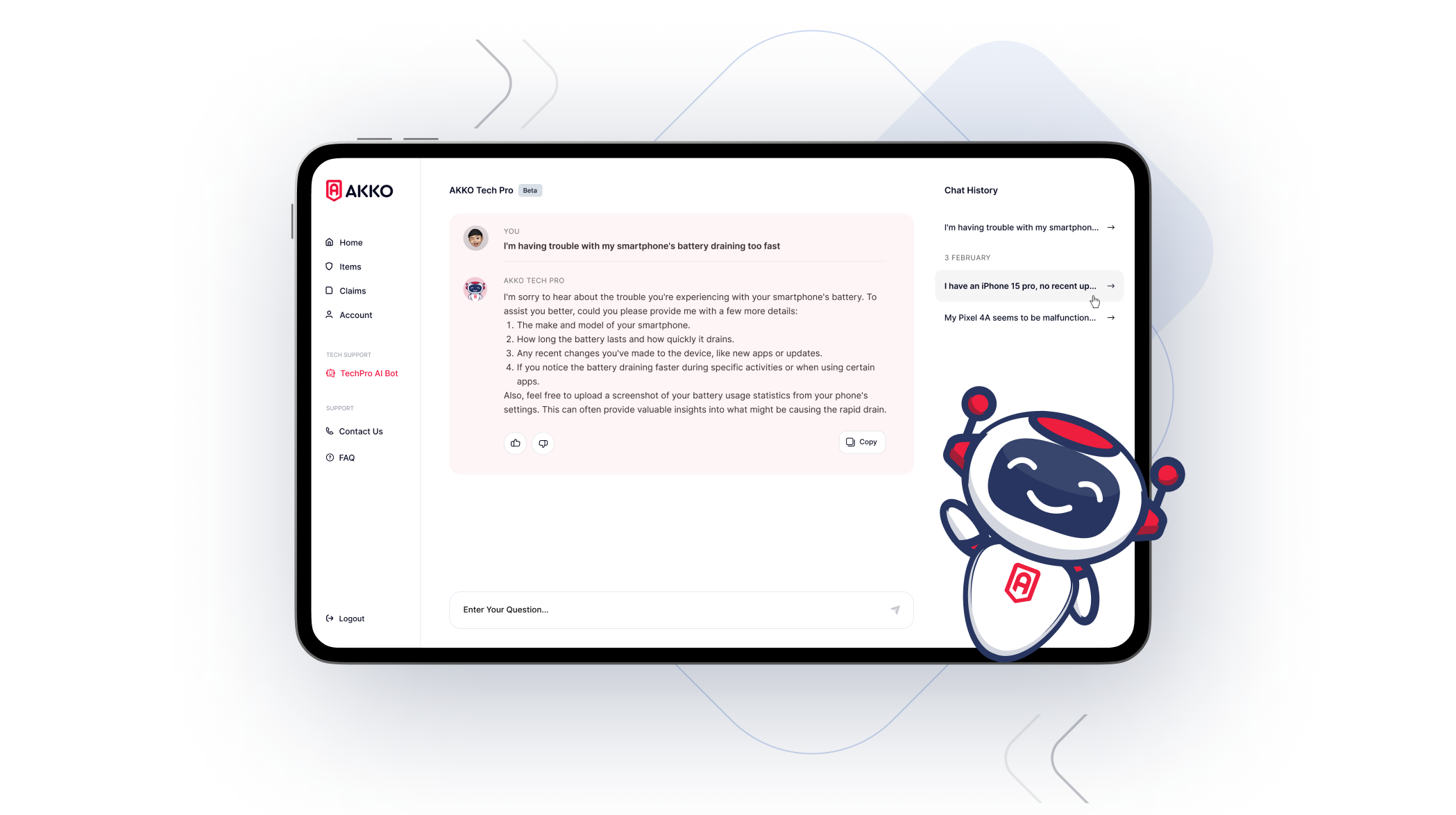

As technology continues to advance, it has become increasingly common for individuals to use their smartphones and other devices to access a wide range of services, including banking and financial transactions. In response to this trend, financial institutions have started to offer device insurance as an added value to their customers.

Device insurance provides customers with peace of mind by protecting their devices against accidental damage, theft, and loss. It also protects any sensitive financial information stored on the device. For customers, having device insurance means that they can quickly and easily replace their device in the event that it is lost or stolen, minimizing any disruptions to their financial transactions.

In addition to the benefits for customers, offering device insurance can also serve as a competitive advantage for financial institutions. As more and more financial institutions begin to offer mobile banking and other digital services, providing device insurance can set a particular institution apart from its competitors and make it more attractive to potential customers.

Financial institutions can also benefit from offering device insurance by reducing their overall risk. By providing coverage for devices, they can reduce the potential for financial losses due to fraudulent activity. This can occur when a device is lost or stolen and sensitive information is compromised.

Device insurance is an essential step that financial institutions should take to ensure the security and convenience of their customers. In today’s world, where smartphones and other devices have become an integral part of our daily lives, providing device insurance is no longer an option but a necessity. It offers customers peace of mind, serves as a competitive advantage, and reduces overall risk for financial institutions. As technology continues to play an increasingly important role in our lives, it is crucial that financial institutions prioritize the security and convenience of their customers by offering device insurance.